Welcome to Episode 118 of Special Situation Investing.

One of our favorite pieces from last summer was titled A Tale of Two Pipelines. It argued the soon-to-be-completed Trans Mountain Pipeline Expansion would be a tailwind for Canadian oil producers. We followed up two weeks later with a write-up on PrairieSky Royalty, as our preferred company to play the pipeline completion.

Now, eight months later, an update on both the pipeline and the company is in order.

Trans Mountain Pipeline Expansion

Chartered in 1951, and completed only two years later, the original Trans Mountain Pipeline (TMPL) is Canada’s sole pipeline connecting its immense oil and gas fields to North America’s West Coast. Its current capacity is 300,000 barrels per day (bpd).

In 2012, the Trans Mountain Pipeline Expansion project was proposed to increase the capacity to 890,000 bpd. The project was supported by potential customers but, over the ensuing fourteen years, it faced constant opposition from environmental organizations, resulting in delays and cost overruns. Last summer, the finish line was in sight. The project was 82% complete with initial product delivery projected for the first quarter of 2024.

Unfortunately, today, two thirds through the first quarter, the project remains incomplete. Additional delays stemmed from opposition to a request to alter the planned route due to hard rock and difficult terrain. But in spite of delays, progress continues and, according to the most recent estimate, the project is 98% complete and first product flow is set for May 1st.

As a reminder, there were three reasons we believed, and still believe, the completion of this pipeline will prove a tailwind for Canadian oil companies:

More pipeline infrastructure will allow Canadian producers to sell more oil. Canada doesn’t have enough pipelines. Total pipeline capacity is approximately 4.6 million bpd and oil production recently hit about 5 million bpd. So the completion of the TMPL Expansion will create a slight excess of transportation capacity, allowing more product to reach market today and room for minimal future growth.

Increased export capability will increase the price of Canadian crude. For decades, Canadian crude has sold at a discount to other international benchmarks such as Brent and WTI. This is because the majority of Canadian pipelines flow south into the United States. Once the TMPL is expanded, more product will flow to the West Coast, thus reaching international markets, fetching a higher price. As there are additional factors at play in the discount, it is unlikely to fully close but it should decrease.

Greater competition among pipelines will decrease toll costs to producers. With more infrastructure, pipeline operators will need to compete for customers.

We still believe TMPL’s expansion will be a positive for Canada’s producers, but it’s clear the increase in capacity is far from what’s needed. If the country’s oil production continues on its recent growth trajectory, even after the TMPL expansion is flowing, maximum pipeline capacity will quickly again be surpassed.

In that scenario, producers will still benefit from getting more product to market; the Canadian crude discount should lessen but remain because the majority of product will still be sold into the United States; and finally, once pipeline capacity is again surpassed, pipeline operators will regain pricing power over their customers.

So, when it finally occurs, whenever that may be, how will the TMPL Expansion affect PrairieSky Royalty, specifically, and how has the company faired since the last write-up?

PrairieSky Royalty Ltd

PrairieSky Royalty owns over 18.2 million mineral interest acres in Canada. The acreage is shown in the image below with the red arrow indicating the starting location of the Trans Mountain Pipeline.

PrairieSky leases mineral rights to dozens of Canada’s top oil producers, both public and private, many of which will be major beneficiaries of the TMPL’s completion. When its customers produce and ship more product, and and if the Canadian crude discount decreases, PrairieSky’s royalty revenue will increase as a result. Because of its asset-light business model, this increase will almost entirely fall to its bottom line to the benefit of its shareholders.

The completion of the Trans Mountain Pipeline Expansion is a when, not an if. When it occurs, PraireSky will benefit. How much it will benefit is a more difficult question. At this point we’re not trying to answer it. Not because it would be hard but because, no matter what the increase is, for us it’s just icing on the cake of a company we believe will be a compounding machine with or without the TMPL’s expansion.

Since we covered the company’s history and details of its business model in our previous piece, today we’ll simply provide an update on its 2023 full year results and highlight a few stand-out characteristics.

Company Results

Here’s a condensed summary of the company’s annual results, announced on February 12th:

Royalty production volumes averaged 24,857 BOE per day, flat with respect to 2022.

Total annual revenue was $513.2 million. This comprised royalty production revenue of $474.6 million—down 23% from 2022—and Other revenue of $38.6 million, which included $26.0 million of bonus consideration from 202 new leases with 110 unique counterparties. This marks the company’s second highest revenue since IPO, second only to 2022.

Annual “funds from operations” totaled $382.5 million. This is a measurement that tracks the cash available for distributing as dividends, repaying debt, repurchasing shares, or participating in acquisitions.

The company declared annual dividends of $229.2 million, representing a payout of 60%.

At year-end, net debt totaled $222.1 million, a decrease of 30% from 2022.

The company also announced a 4% increase in its annual dividend, up $0.04 to $1.00 per common share.

All in all, it was a solid year. Revenue was almost at all time highs. Dividends reached all time highs. But the best part is this is just the latest in a trend of positive results for PrairieSky.

An Early-Stage Compounder

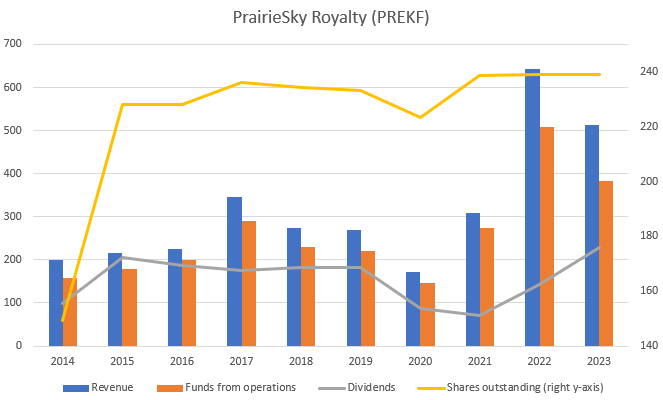

We created the chart below to help visualize PrairieSky’s strong performance since IPO. Note Revenue, Funds from operations, and Dividends are all plotted against the left y-axis, while Shares outstanding is plotted against the right y-axis.

The first observation is that PrairieSky is a young company, only hitting its ten-year anniversary this year. But it has had a solid first decade.

For starters, the company never had a losing year. This is largely because of its asset-light, royalty-based business model with low operating cost and no capital costs. The company also only has 66 employees. Low operating costs make the company highly profitable. It often sports operating margins in the mid nineties. The average margin for 2023 was uncharacteristically low at 89%.

As depicted by the yellow line in the above chart, PrairieSky both issued and bought back shares. The company began with about 150 million shares and now has 239 million, a 60% dilution. The vast majority of that dilution occurred in its two years. Since year-end 2015, the company only diluted 4.8%. We tend to dislike share dilution, but we’re encourage to see that, while management used shares to fund acquisitions, it was accretive on an acre-per-share basis.

The company hasn’t solely relied on shares to fund acquisitions, it also used debt and cashflow.

Two trends we didn’t capture in our chart are net debt and funds employed in acquisitions.

The company has reduced its net debt over recent years. Here are the numbers since 2021:

2021: net debt at December 31st was $635 million

2022: net debt at December 31 was $315.1 million

2023: net debt at December 31 was $222.1 million

In its 2023 Q3 earnings call, the CEO estimated PrairieSky will be debt free/in a net cash position by the first quarter of 2025. Debt reduction is clearly a priority and in its current state the company can fund itself, so it has little need for debt. Zero debt would make the company even more attractive to us.

Lastly, PrairieSky, supported by its high margins, has proved a consistent dividend payer. Dividends decreased in 2020 and again in 2021, but since then have been increasing. This past year, dividend payout hit a record $230 million.

As you can see, PrairieSky had a solid first decade. That said, its share price has underperformed the indexes and peers, but we believe the company is trending in a very positive direction. It’s allocation strategy of a bit of everything—buying back stock and other times issuing more, paying dividends, paying down debt, and acquiring new assets—reminds us of the balanced approach taken by Eagle Materials. If it proves to have anything close to Eagle Material’s track record, PrairieSky has a lot of upside ahead.

Conclusion

With that we’ve wrapped up another episode of the show. If you enjoyed this information or found it helpful, please share it with like-minded friends. We appreciate your support, honestly we do. Some of you have literally become our friends through this medium. Thank you. We look forward to seeing you all again next week.

Share this post