Welcome to Episode 110 of Special Situation Investing.

I was ten when I first encountered the Frequency Illusion—the psychological phenomenon where, once introduced to something, it is then noticed more often. It was the day a friend’s family arrived at church driving the first cosmic blue Toyota Matrix I had ever seen. On the way home that afternoon, I saw seven.

Today’s topic was inspired by a recent encounter with this phenomenon.

It kicked off when I read about the importance of cement in Vaclav Smil’s book, How the World Really Works. I later ran across a Substack article about a family-owned cement business. The next week, while on my annual trek into the Rocky Mountains to fell our family Christmas tree, the only thing on the radio was an episode of the How I Built This podcast about a company making eco-friendly cement. Lastly, an investment firm we follow closely mentioned a new investment in, you guessed it, a cement company.

A Familiar Setup

Upon diving into the sector, we observed a familiar incongruency between narrative and reality, and we realized cement could be right up our alley.

A general web search for cement reveals the mainstream focus with article after article bemoaning the 8% of global carbon emissions that result from the production of cement. Not to be left out, the International Energy Agency website answers the question “Why is cement important?” beginning with the following sentence:

Reducing CO2 emissions while producing enough cement to meet demand will be challenging.

Compare this to how the book How the World Really Works talks about concrete, a critical modern material, of which cement is a critical component:

Reinforced concrete is now inside every large modern building and every transportation infrastructure, from port piers to segmental rings installed by modern tunnel-boring machines (under the channel or Alps). The standard configuration of the US Interstate Highway System is a layer of about 28 centimeters of non-reinforced concrete on top of twice as think layer of natural aggregates (stones, gravel, sand)—and the entire Interstate System contains about 50 million tons of cement, 1.5 billion metric tons of aggregates, and only about 6 million tons of steel.

So, like coal and oil, topics we’ve written extensively on in the past, cement appears simultaneously hated and critical to maintaining/growing the world’s standard of living. This setup could create a situation where cement companies produce lots of cash, but maintain low PE ratios, leading to massive buyback and dividends.

High rates of share repurchases was, after all, why the previously mentioned investment firm made its new investment. We decided to acquaint ourselves with the cement industry by researching the company they mentioned—Eagle Materials (EXP).

The Company

Eagle Materials was formed in 1963. It was originally a subsidiary of Centex Corporation but was spun-out to shareholders as a separate entity in 1994.

Today, the company is a leading U.S. supplier of construction and building materials. Its operations are split in two segments—Heavy materials and Light Materials. Heavy Materials includes concrete, cement, and aggregates which are used in infrastructure and building construction of all types. Light Materials encompasses the company’s production of gypsum wallboard (think Sheetrock) and recycled paperboard which are used in residential construction. The company’s reports claim the following:

We operate eight modern cement plants (one of which is operated through a joint venture), and one slag grinding facility. Our clinker capacity is approximately 6.7 million tons, which is approximately 6% of total U.S. clinker capacity. Clinker is the intermediary product before it is ground into cement powder.

In addition to production facilities, we also operate over 30 cement storage and distribution terminals, including the Stockton, California terminal purchased on May 3, 2023.

Our cement companies focus on the U.S. heartland and operate as an integrated network selling product mainly in Colorado, Illinois, Kansas, Kentucky, Indiana, Iowa, Missouri, Nebraska, Nevada, Ohio, Oklahoma, Tennessee, and Texas. Our Joint Venture (as defined below) includes a minority interest in an import terminal in Houston, Texas, from which we can purchase up to 495,000 short tons annually. Our slag facility is located near Chicago, Illinois and has 500,000 tons annual grinding capacity.

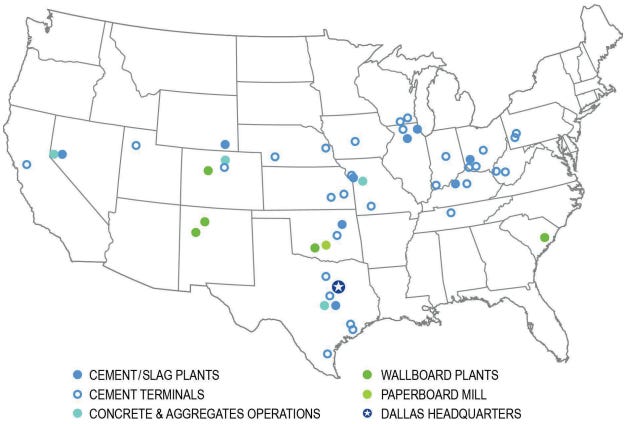

Additionally, EXP operates five aggregates facilities and five gypsum wallboard plants. The locations of EXP’s properties are shown in the image below, revealing a concentration in the lower and mid United States.

One aspect of the company apparent when reading its reports is a focus on the essentials, or what it literally calls its “no-frills” culture. The company is relentless about “focusing on value-adding activities.” In particular, this manifests as a focus on core competencies while ignoring all else. For example: EXP writes clear and concise reports; its acquisitions stay within a limited circle of competence and are value-additive; and its operations and decisions are handled in a decentralized manner with its subsidiaries given autonomy. In short, EXP’s culture is one of focusing on its core business with minimal BS. The result is that EXP has an impressive track record.

Take a look at the table below.

Most of EXP’s numbers are up and to the right. It’s also clear the company took a big hit in 2020. In particular, the company’s margins and net income broke a steadily rising trend, falling to decade lows in 2020, but now are both now reaching all-time highs.

On a per-share basis, EXP’s revenue, earnings, FCF and dividends have steadily increased over the last ten years (with a momentary exceptions in 2020). While impressive, this is partially a result of steady share repurchases.

The Situation

EXP’s share buybacks are not a temporary special situation. They are a long-term pillar of the company’s strategy.

We previously covered two buyback monsters—Alpha Metallurgical Resources and CONSOL Energy. These companies recently kicked their share repurchase programs into high gear. In stark contrast, EXP has consistently bought back modest amounts of stock for years, sporting a 5-year average buyback yield of 7.36%.

A look back as far as 2011, shows shares outstanding beginning at 44 million, peaking at 50 million in 2015, and steadily decreasing ever since to the current 35 million. A press release from August, 2015 announced an increase in the allowed share repurchases up to 7.5 million shares. Of that 7.5 million, only 700,000 remained in May of 2019 when the company increased the amount to 10.7 million.

The steady repurchases continue unabated. In its last earnings call, the company reported the following:

We also repurchased a total of 917,000 shares or 2.5% of our outstanding for $151 million in addition to paying our quarterly dividends, returning a total of $169 million to shareholders during the first half of our fiscal year. We have approximately 6.8 million shares remaining under our current repurchase authorization.

Repurchases of two and a half percent of its market cap over six months is below average but this was accomplished concurrent with a $55 million acquisition. With 34,886,889 total shares outstanding and 6.8 million shares remaining in its current repurchase program, the company has the ability to buyback 19.5% of its market cap. What we believe is more relevant, though, is the company appears content to continue buying back shares steadily and at the rate of 5-7% per year.

In addition to buybacks, EXP pays a steady dividend of $0.25 per quarter, makes regular acquisitions, and makes CAPEX investments in its production plants. Here’s how the company explains its allocation priorities in its annual report:

Our capital allocation priorities are intended to enhance shareholder value and are as follows: 1. investing in growth opportunities that meet our strict financial return standards and are consistent with our strategic focus; 2. operating capital investments to maintain and strengthen our low-cost producer positions; and 3. returning excess cash to shareholders through our share repurchase program and dividends.

In the past five years, we have invested nearly $857.8 million in acquisitions, $476.7 million in organic capital expenditures, and approximately $1.7 billion in share repurchases and dividends. Since becoming a public company in 1994, our share count is down nearly 48%, and we have returned approximately $3.2 billion to our shareholders through a combination of share repurchases and dividends.

The result speaks for itself as EXP has outperformed the S&P 500, as the chart below shows, averaging an annual return of 16.7% verses the index’s 9.4%, since 1995.

Powerful Pricing Power

Cement companies like EXP—boring and untouchable, similar to coal and oil companies—could prove a surprising winner in the years ahead. There are two aspects of the cement market that could continue to give the companies strong pricing power.

First, supply is not keeping up with demand. EXP’s management said as much in its last earnings call:

On the supply side, U.S. manufactured cement supply continues to be outpaced by demand.

Total capacity has fallen since 2010 when further regulations were enacted known as niche, making new plant construction and capacity expansion challenging. This creates the ingredients for a strong pricing environment.

And the situation is unlikely to change any time soon. According to management:

We have very stringent permitting requirements in our industry. Because of this, we do not perceive any significant new plant builds or expansions in our markets that would materially change the supply picture. The natural consequence of these two factors is sustained pricing power.

Not a great situation for the economy but an awesome cocktail for existing suppliers of construction materials.

A second reason pricing power will likely persist is because cement companies are local monopolies. Building materials such as cement, concrete, aggregates, and gypsum wallboard are heavy and therefore expensive to transport making it nearly impossible for distant competitors to compete economically. This creates multiple mini-markets within which each player is a de facto monopoly. Management hinted at this in its latest annual report, writing:

Because of its low value-to-weight ratio, the relative cost of transporting cement on land is high and limits the geographic area in which each producer can market its products profitably. Management believes shipments of cement by truck are generally limited to a 150-mile radius from each plant, with the shipping radius increasing to up to 300 miles by rail, and further by barge. Therefore, the U.S. cement industry comprises numerous regional markets rather than a single national market.

So because the cement industry is experiencing a supply/demand imbalance and because cement companies are essentially local monopolies, they should be able to maintain strong pricing power for the foreseeable future. This in turn could mean high returns for investors. We believe this setups up a situation well worth digging further into and plan to do so in the weeks ahead.

Conclusion

With that we’ve wrapped up the latest episode of the show. We hope you got something out of this initial look at a new industry and a new company. We like what we see in cement, and EXP in particular, but we haven’t put any money to work in the space yet. We have a lot more work to do.

Thanks again for all your support and feedback. We’ve seen an uptick in reader interaction on our Substack page as you all chime in with your own thoughts and ideas. We love hearing from you guys. Thank you. We’ll see you all next Saturday on the next episode.

Share this post