Welcome to Episode 93 of Special Situation Investing.

Today, we bring you Permian Basin Royalty Trust (PBT), yet another commodity-based royalty company. It may appear that we’re obsessed with this narrow niche within the broader market, irrespective of the value that can be found elsewhere, but I assure we find value alluring no matter where it happens to be. It just so happens that, these days, we’re finding a lot of value in this narrow sliver of the market.

The reasons we’re finding value in the commodity royalty space are threefold. First, commodities are hated in the time of ESG and are therefore ignored by most other investors. Second, commodity extraction companies are at the tail end of a decade or more of infrastructure underinvestment and are therefore limited in their ability to meet market demands. Third, royalty companies are pass through vehicles that benefit from higher commodity prices without suffering the higher operating costs incurred by operators, particularly in periods of high inflation.

Now, at first glance, the stock price chart of PBT, does not look like a bargain buy. It’s up 10x since it’s 2020 lows, trust me I know, and no I didn’t buy at the bottom. So why look for value in PBT after its recent parabolic rise? Well, that is exactly the question I hope to answer in this short writeup and our journey begins by remembering…price is what you pay and value is what you get.

Permian Basin Royalty Trust was created via the same transaction that created San Juan Basin Royalty Trust in 1980. At the time, the royalty interests were split into two separate publicly traded trusts with the New Mexico oil and gas rights going to San Juan Basin Royalty Trust and the Texas royalties going to Permian Basin Royalty Trust.

The principle assets of PBT consist of two distinct oil and gas fields in the Texas Permian Basin. The Texas Royalty Properties, are the larger of the two assets and are spread out among 33 Texas counties. PBT holds a 95% net overriding royalty interest in the property, but despite the more expansive property size and the high royalty rate, the production from the Texas Royalty Property is much lower than PBT’s Waddell Ranch property.

The Waddell Ranch Property grants a 75% net overriding royalty interest to the Trust and produces the lions share of the Trust’s revenue stream, over 80%. The Waddell Ranch property is confined to just Crane county Texas and the property is operated by a privately held company called Blackbeard Operating LLC.

Now, in order to understand the valuation thesis behind PBT, we have to understand the character of the royalty it receives. According to the Trust’s original prospectus:

A “net overriding royalty” is a mineral interest which represents a share of production as measured by net profits from the operation of a property or properties. In this regard, a “net overriding royalty” is equivalent to a “net profits interest” and differs from an “overriding royalty”, which is a share of gross production not reduced by the costs of exploration, development, and production.

The key concept, is that a fixed percentage of the operato’s net profits go to the trust rather than a percentage of the operator’s gross production. An overriding royalty would entitle its owner to a profit even when the operating company produced a loss whereas the net overriding royalty only pays the owner when the operator profits and then only pays an agreed upon percentage of the operator’s profits.

Because the trust takes a percentage of the operators profits after expenses, it is sometimes in the trust’s best interest to support increased capital expenditures by the operating company. This is because the capital expenditures should make the property more productive, which should increase the operator’s profits, which should then increase payouts to trust. The trust doesn’t, strictly speaking, make a capital investment into the underlying property but in a sense it does invest in the property in that it forgoes, for a time, its ability to profit share with the operator, who’s profits have been reduced by the same capex that’s going into the underlying property.

In PBT’s case specifically, it played out like this. Blackbeard, a privately held oil and gas operating company, took over operations on the Waddell Ranch property from Conoco in April of 2020. Blackbeard observed that production was in decline and that a serious capital investment program, if undertaken, would maximize the remaining life of the Trust’s properties and yield greater production over the long term. Recognizing the wisdom of the proposal, PBT agreed to the capital expenditure plan knowing full well that, for a time, Blackbeard would be less profitable and would make proportionally reduced payments to the Trust. PBT also knew, however, that in the end the increased productivity of the property would lead to greater royalty payments after the increased capex phase was over.

PBT’s 2022 annual report discusses the capital expenditure plan as follows:

Total capital expenditures in 2022 used in the net overriding royalty calculation were approximately $124.3 million (gross) compared to $66.6 million (gross) in 2021 and $10.3 million (gross) in 2020. The operator of the Waddell Ranch properties has informed the Trustee that, in order to halt the production decline curve and to exploit the remaining potential of the Trust’s assets more fully, a more aggressive, robust capital expenditure budget will be necessary in the future and is being pursued.

The report goes on to state that:

Blackbeard has advised the Trustee that the proposed budget for 2023 will be $122 million (net). The 2023 budget will include amounts to be spent on 48.75 (net) horizontal wells targeting the Sandhills and McKnight formations, along with various other recompleted wells prospects to be worked over and completed, and also amounts to be spent on additional facilities and infrastructure improvements and the completion of projects begun in 2022.

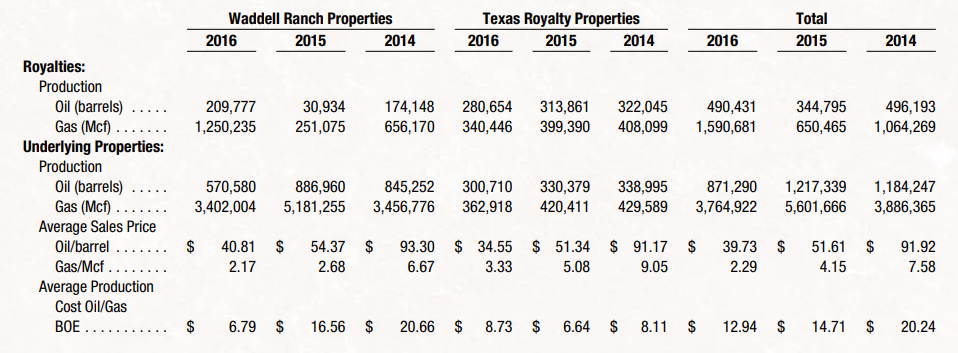

At the time of this writing, a $120 mm capital expenditure represents just over 12% of PBTs $960 mm market cap, leading any prudent investor to ask if the significant increase in Blackbeard’s capex is justified. To determine whether or not it is justified, a deeper look into the Trust’s annual report is needed, beginning with a chart labeled Oil and Gas Production. The chart displays the Trust’s underlying property production history over a three year period, including total oil and natural gas production, Waddell Ranch production, and Texas Royalty Properties production.

Reviewing production levels from 2014 through 2022, we see that the Texas Royalty Properties have been in slow but steady decline for years. Over the same period, production from the Waddell Ranch properties remained consistent producing about 3.5 mm Mcf of natural gas and between 600-800k barrels of oil per year without much variation. Between 2020 and 2022, however, Waddell Ranch production quadrupled for both oil and natural gas running up from 583k barrels of oil and 3.3 mm Mcf of natural gas in 2020, to 2.0 mm barrels of oil and 12.4 mm MCF of natural gas in 2022. Because Waddell Ranch was already the most producing field owned by PBT, the increase in its production had a commensurate 4x increase effect on the Trust’s total oil production between 2020 and 2022.

The reason for the dramatic increase in production was, of course, the increased capex that Blackbeard put into the Waddell Ranch property after they took over in April of 2020. It should further be noted that the Waddell Ranch lifting cost on a barrel of oil equivalent (BOE) basis was $17.58 bbl in 2022 as compared to $17.71 in 2021 and $32.92 in 2020. In other words, PBT’s production quadrupled in just three years and its lifting cost per barrel was halved. This indicates that profits for both the operator and the Trust will increase markedly once capex spending returns to historically normal $2-10 mm per year levels on Waddell Ranch.

To better understand the scope of Blackbeard’s capex budget in relation to the Trust’s distributable income consider the following. PBT made $54 mm in royalty income in 2022, of which $53 mm was distributed to unit holders. For the sake of argument, let’s assume that in 2024 the same amount of oil was sold by the Trust at the same price as in 2022 but with the exception that Blackbeard did not spend $120 mm on Waddell Ranch capex. Let us further assume that a still healthy $20 mm was spent on property related capex and that the remaining $100 mm was available as profit to Blackbeard. In this case, PBT would be entitled to 75% of the $100 mm, or $75 mm, in additional royalty payments.

This would raise the royalty income for 2024 from $54 mm to $129 mm and bring PBT’s P/E ratio down from today’s 18 to just over 7. Of course, the bullish case is made stronger by the fact that PBT is required to payout nearly all of its royalty income to unit holders and when the dividend yield increases from 4% to something closer to 13%, the price per share will have to rise in order to bring the stock into line with other comparable stock yields. Beyond this, however, the owners of the Trust will be entitled to all of the increased earnings for years into the future which, after all, is why we’re investing in businesses in the first place.

The only real question that remains is, how much longer will Blackbeard’s increased capital expenditure plan go on for? The timing of investment payoffs is a question which has stymied investors for ages and is one that we must once again contend with in thinking through the PBT thesis. Buffett, famously complimented Aesop who, in 600 BC, nearly described the process of discounting to present value when he said that “A bird in hand is worth two in the bush.” The only thing that remained, Buffet explained, was to determine how long it would take to get the two birds out of the bush and to compare the discount rate of waiting for the birds in the bush to the risk free rate of government bonds.

Sadly, because Blackbeard is a private company, we couldn’t get any hard data detailing its full capex plan for the Waddell Ranch property. We can infer a few things from publicly available information, however, to include the fact that the 2023 capex budget describes the need to complete projects that began in 2022 without mention of starting additional projects slated for completion in 2024. Furthermore, the property itself is fairly small and can probably only take so much investment capital. It would seem that much of the increased efficiencies have already been gained given the halving of Blackbeard’s lifting cost per barrel coupled with a quadrupling of production output. In any case, we know that anything that can’t go on forever, ends, and that this project too will end at which point PBT unit holders will reap the rewards.

So, given the above rather simple analysis, we can see that there is still room to run in this no debt, royalty business opportunity. Do I wish I’d bought the stock for under $3 a few years back, yes, but am I willing to let that keep me from building up a position today with a still significant tailwind at my back, no.

Well, with that we wrap up another episode of the show. We hope that you’re finding value in these short but actionable investment write-ups and we look forward to bringing you another insightful episode next week. If you are finding value in the show and if you do listen on the fountain podcasting app a small boost is always a great encouragement for us. We’ll see you all next Saturday on another episode.

Share this post