Remember you can support the show in the following ways:

To sign up for Strike visit the following link : https://strike.me/en/

To get $10 for you and $10 for me at sign-up use referral code: ZEYDWP

Or contribute to the show directly by visiting: https://buzzsprout.com/1923146

Once on the shows website you can scan the QR code displayed and donate any amount of bitcoin to show your support

Listen to the Special Situation Investing Podcast on Fountain, on Apple Podcasts, on the website, or wherever you listen.

Welcome to Episode 46 of Special Situation Investing where we enjoy sharing our research to help kick-start yours.

To start today’s episode, let’s begin with advice on investing from Warren Buffett’s business partner, Charlie Munger. He says:

“Over the long term, it’s hard for a stock to earn much better return than the business which underlies it earns. If the business earns six percent on capital over forty years and you hold it for that forty years, you’re not going to make much different than a six percent return — even if you originally buy it at a huge discount. Conversely, if a business earns eighteen percent on capital over twenty or thirty years, even if you pay an expensive looking price, you’ll end up with one hell of a result.”

This quote from Charlie is reminiscent of what Buffet himself stated in his 1992 shareholder letter. He wrote:

“Leaving the question of price aside, the best business to own is one that over an extended period can employ large amounts of incremental capital at very high rates of return.”

The concept of return on capital (ROC), or sometimes referred to as return on invested capital (ROIC), is rather straight forward. For those who think in formulas, the equation for ROC is:

ROC (or ROIC) = (net income - dividends) / (debt + equity)

For those who’d rather take an icepick to the eye than decipher equations, here’s another way of explaining it.

Consider a simplified example of owning a single family rental. Let’s say the purchase price of the home was $200,000 with a $40,000 down payment. Within the first year after the purchase the mortgage principle is paid down $5,000, leaving $155,000 of debt and $45,000 of equity. Also in the first year, $5,000 was received in after-tax rental income. Since dividends don’t apply in this example, the ROC calculation is quite simple. Take the net after-tax income of $5,000 and divide it by the sum of the debt and equity ($155,000 + $45,000). The ROC is $5,000 divided by $200,000 which equals 5%. It’s probably safe to assume that Buffett would politely pass on this hypothetical investment.

Hopefully now it’s clear how ROC can give a sense of a business’ operating performance by showing how efficiently the company is compounding its capital. It is often used as a gauge to measure the quality of a company

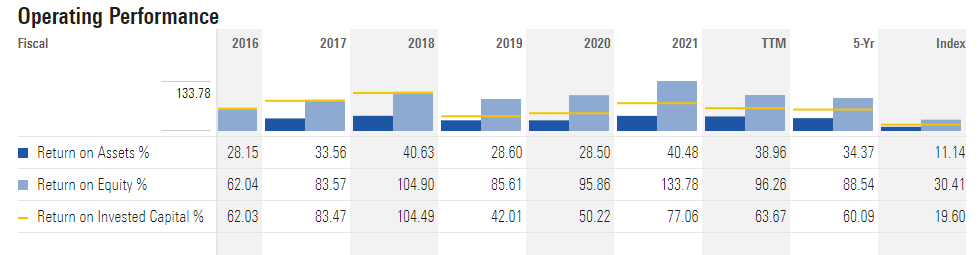

The company we’re discussing today has an incredible track record of return on capital. Looking back over the past ten years, this company has recorded ROC as high as 104% and never lower than 32%. According to a table on Morningstar, the company’s current five year average ROC sits at 60%.

If you hadn’t read the title for this episode, you might now be imagining the likes of Google, Microsoft, Apple, or some other technology mega cap. While those companies have respectable five year average ROCs of 17%, 23%, and 32%, respectively, they fall far short of today’s company’s 60%.

If instead you thought of Texas Pacific Land, I could understand why because TPL has a stellar five year average ROC of 82%. But although both hosts of this show own TPL and are bullish on its long-term prospects, at this point, we’ve already devoted two full episodes, numbers 16 and 30, to TPL. Today, we are discussing another fascinating company, OTC Markets Group.

As its name implies, OTC Markets Group (ticket OTCM) is in the business of operating over-the-counter markets which are utilized by over 12,000 US and international securities.

The company had its genesis as the National Quotation Bureau back in 1913. After changing hands multiple times, it was bought by a group of investors led by the company’s current CEO, Cromwell Coulson, in 1997.

Under its current leadership, OTCM’s mission is clearly stated: “to create better informed and more efficient financial markets.” To accomplish this, the company operates three lines of business:

The first is OTC Link LLC which operates three alternative trading systems (ATS). As opposed to national exchanges, such as the NYSE and the NASDAQ, OTCM’s alternative trading systems allow broker-dealers to publish quotes, communicate and negotiate directly within OTC Link; no third-party exchange necessary. Boiled down to the nuts and bolts, think of it as an SEC-approved version of WhatsApp. For providing this service, OTCM receives both subscription and transaction-based fees. As of June 30th, OTC Link had 189 subscribers.

Market Data Licensing is the second line of OTCM’s business. This is were OTCM provides access, via subscription, to data collected from the transactions occurring across its markets, as well as other financial and compliance data for 12,000 securities. The majority of OTCM’s revenue from data licensing comes from sales through other market data distributers such as Bloomberg, REDI Technologies and Thomson Reuters. As of June 30th, OTCM Market Data Licensing subscribers totaled over 26,000 professional users and approximately 17,000 non-professional users.

The third line of OTCM’s business is what’s called Corporate Services. Here OTCM provides three tiers of markets for companies to be listed publicly. The tiers are based on the quality and amount of information the companies provide. The top tier is the OTCQX Best Market, where companies must meet stringent standards to qualify. OTCQX contains both US and international securities. The international securities are primarily firms already on an international exchange but choose to list on the OTCQX to avoid the more burdensome requirements of US exchanges. There are other international firms that list on the OTCQX while simultaneously pursuing listing on a US exchange.

The next tier down is the OTCQB Venture Market. While also open to national and international securities, the level of standards is lower than OTCQX, but still promotes price transparency and public disclosure. The companies listed on this market tend to be in the entrepreneurial and developmental stages. Companies listed on these two top-tier markets pay OTCM one-time application fees and additionally either annual or semi-annual fees.

If a company chooses not to apply for listing on either of the two previous markets, or does not meet those standards, its securities can be listed on OTCM’s lowest tier market, the Pink Open Market.

While not a stock exchange like Intercontinental Exchange (ICE) or CME Group (CME), OTCM has a business model similar enough that we include it on a watchlist along with the exchanges mentioned, as well as a few others. While it has produced stellar results during past non-inflationary times, we believe the exchange business model may also provide outperformance during high inflation and perhaps may even benefit from it. A few positive attributes of the business model include: not being capital-intensive but instead asset-light, benefiting from market volatility, requiring relatively few employees, acting as toll collectors within an essential sector of global economies, and having large moats with high switching costs. (If interested in learning more about one of our favorite exchanges, check out episodes 23 and 24.) OTCM Group shares these attractive investment characteristics. There are three characteristics on which it’s worth providing a bit more detail.

First, as we mentioned earlier, OTCM has an extraordinary ability to compound capital. Measured on a basis of ROC, OTCM’s 60% handily outperforms even companies within the security exchange sector. For example, Intercontinental Exchange and CME Group both have an ROC of 10% over the past five years, and Australia’s largest securities market, ASX, came in at a five year average ROC of 11%. And as shown earlier, OTCM has much higher returns on capital than even the most beloved tech stocks.

In addition to ROC, OTCM’s ability to compound is shown in another closely related metric - return on equity (ROE). Here OTCM’s five year record is an impressive 88%.

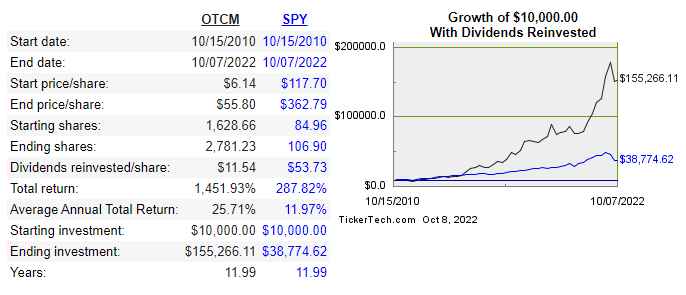

As one might expect with such a record, OTCM’s stock price has appreciated at a rate far and above the S&P 500. A graph comparing the performance of OTCM vs the S&P, reveals that, since it went public in 2010, with dividends reinvested, OTCM outperformed the market approximately 1400% to 300%. OTCM’s average annual return over that same period is 26%, compared to the S&P’s 12%.

Another attractive characteristic of OTCM is its relatively small size. Comparison exchange companies, such as ICE and CME, have market caps almost two orders of magnitude larger than OTCM’s. ICE and CME’s market caps, for example, are $50 and $61 billion, respectively, while OTCM has a market cap of $660 million. Many large investment firms and funds are not able to purchase securities of such small companies at any worthwhile scale due to lack of liquidity.

Consider for example Berkshire Hathaway’s recent purchases of Occidental Petroleum (OXY). Over the course of a few months, Berkshire bought up approximately 20% of OXY which is worth about $13 billion. That amount is 20 times the total market cap of OTCM. Clearly Berkshire is out of OTCM’s league. Although Berkshire Hathaway is an extreme example, there are hundreds of firms and funds that simply can’t invest in OTCM because it’s too small.

In addition to its smaller market cap, extreme illiquidity would make OTCM a no-go for most large investors. It’s average daily trading volume is only 2.5 thousand shares. That’s a miniscule number even for a company of OTCM’s size. With large investors possibly forced to ignore OTCM’s stock, an opportunity for small investors with less cash to employ could become available.

The third characteristic we’d like to highlight is OTCM’s high insider ownership. Of the 11.8 million shares outstanding, 4.1 million, or 35%, are owned by officers and directors of the company. As of OTCM’s latest annual report, the company’s CEO, Cromwell Coulson, alone owned 3.2 million of those shares, with the difference spilt between 11 other officers and directors.

Insider ownership is most often a positive attribute since the officers and directors share skin-in-the-game with other shareholders. There is a risk however when one person owns so much stock, and thus so much voting power, as in the case with Coulson. But with so much of his net worth wrapped up in the success of the company, we believe his incentives are aligned with other shareholders. This is further emphasized by the fact that 884,000 common shares, or 7.5% of the company, is locked in a trust, the beneficiaries of which are Cromwell’s wife and children.

With so much invested in the success of the company, the officers are likely highly incentivized to act in the long-term benefit of all shareholders.

To wrap up today’s episode, we believe that OTCM Markets Group is a company worth doing further research on and possibly putting on one’s watchlist. On first inspection, it appears to be a great long-term compounder evidenced by high rates of ROC and years of market out-performance. Illiquidity of the stock could provide opportunities for small investors, especially if market volatility produces days with higher that average volume. And lastly, with such high insider ownership, company leadership is well aligned with common shareholders to continue the company’s success for years into the future.

We’ll conclude with a quote from Buffett in the 2007 Berkshire Hathaway shareholder letter. He wrote:

“We want to buy a great business, defined as having a high return on capital for a long period of time, where we think management will treat us right.”

That wraps up Episode 46. We hope you found it helpful and education. Remember, you can find the transcripts for all our episodes that include the charts and tables we reference at specialsituationinvesting.substack.com.

SUBSTACK ONLY BONUS

For the equivalent of a master degree in investing, check out the Buffet Partnership Letters here; the Berkshire Hathaway Shareholder Letters here; and Charlie Munger’s WESCO Financial Letters to Shareholders here.

Share this post