Welcome to Episode 109 of Special Situation Investing.

One of the great things that’s come from this podcast is the interaction with all of our listeners. Recently, one of you posted the following question regarding Episode 106 and Natural Resource Partners (NRP):

Are you guys worried about the GP’s [general partner] call option to buyout the LP [limited partner] if it and it’s “affiliates” own 80% or more of the stock? If “affiliates” include the board of directors, then they’re already near or past 80%.

I’ll admit upfront that this wasn’t a risk we’d been thinking about. We like the economics of NRP’s royalty model along with it’s exposure to commodities and had been focused on that side of the investment without considering the potential risk highlighted in this listener question. That said, we appreciate the question and the deeper understanding of the company we gained from researching the following answer.

The Call Option

Perhaps the best place to begin answering the question posed to us is to explicitly state the terms of the GP’s call option as defined in NRP’s 2022 annual report. According to the annual report:

Our general partner has a limited call right that may require unitholders to sell their units at an undesirable time or price.

If at any time our general partner and its affiliates own 80% of more of the common units, the general partner will have the right, but not the obligation, which it may assign to any of its affiliates, to acquire all, but not less than all, of the remaining common units held by unaffiliated persons at a price generally equal to the then current market price of the common units. As a result, unitholders may be required to sell their common units at a time when they may not desire to sell them or at a price that is less than the price they would like to receive. They may also incur a tax liability upon a sale of their common units.

Affiliate Ownership

Figuring out what percentage of NRP’s total common units are held by affiliates is the logical first step in ascertaining the risk posed by the GP’s call option, but I’ll admit that finding the exact information took some real digging into the company’s reports. This is because several entities are listed explicitly as affiliates while others are implied affiliates and because the direct common unit ownership of each entity is not listed clearly in any one chart in the annual report.

The Rosetta Stone that finally unlocked the hieroglyphics of NRP’s insider ownership turned out to be right on the opening pages of the annual report where it states:

The aggregate market value of the common units held by non-affiliates of the registrant on June 30, 2022, was $334 million based on a closing price on that date of $37.23 per unit as reported on the New York Stock Exchange.

With that information, we can divide the non-affiliate market cap of NRP by the trading price on that date to determine the number of shares owned by non-affiliated entities.

$334,000,000 / 37.23 = 8,971,259 shares owned by non-affiliated entities.

Next, we have to determine the percentage of shares outstanding owned by non-affiliates. This can be accomplished by dividing the number of non-affiliate owned shares by the total shares outstanding.

8,971,259 / 12,634,642 = 71% of shares outstanding owned by non-affiliates.

Interestingly, the percentage of common units outstanding owned by non-affiliates has remained steady for at least the last several years with the following exact numbers bearing that out.

2021

8,962,264 / 12,505,966 = 71% of shares outstanding owned by non-affiliates

2020

8,941,755 / 12,351,306 = 72% of shares outstanding owned by non-affiliates

The General Partner

Establishing the fact that affiliates control less than 29% of common units outstanding might lead us to believe that the 80% threshold is far from being met but we must remember that both the GP and the affiliates ownership must add up to 80% of common units outstanding. So who is the GP and how do we determine their ownership?

Revisiting NRP;s 2022 annual report will further illuminate this question:

Our operations are conducted through Opco and our operating assets are owned by our subsidiaries. NRP (GP) LP, our general partner, has sole responsibility for conducting our business and for managing our operations. Because our general partner is a limited partnership, its general partner, GP Natural Resource Partners LLC, conducts its business and operations and the Board of Directors and officers of GP Natural Resource Partners LLC make decisions on our behalf. Robertson Coal Management LLC, a limited liability company wholly owned by Corbin J. Robertson, Jr., owns all of the membership interest in GP Natural Resource Partners LLC. Subject to the Board Representation and Observation Rights Agreement with certain entities controlled by funds affiliated with Blackstone Inc. (collectively referred to as "Blackstone") and affiliates of GoldenTree Asset Management LP (collectively referred to as "GoldenTree"), Mr. Robertson, Jr. is entitled to appoint the members of the Board of Directors of GP Natural Resource Partners LLC and has delegated the right to appoint one director to Blackstone.

The senior executives and other officers who manage NRP are employees of Western Pocahontas Properties Limited Partnership or Quintana Minerals Corporation, which are companies controlled by Mr. Robertson, Jr. These officers allocate varying percentages of their time to managing our operations. Neither our general partner, GP Natural Resource Partners LLC, nor any of their affiliates receive any management fee or other compensation in connection with the management of our business, but they are entitled to be reimbursed for all direct and indirect expenses incurred on our behalf.

So, according to the statement above Mr. Robertson Jr., NRP’s CEO and Chairmen of the Board, fully controls the GP and by extension his common unit ownership counts toward the 80% threshold required to activate the call option on non-affiliate units. The 2022 annual report’s Security ownership of certain beneficial owners and management table shows that Mr. Robertson Jr., controls 20% of the common stock of NRP.

If we add Mr. Robertson’s total unit ownership to the affiliated ownership number we see that his 20% common unit ownership combined with 29% ownership by affiliates adds up to 49% which, while significant, falls short of the 80% threshold.

Limitations to NRP Common Unit Holder Rights

Based on the information already presented, it doesn’t appear that common unit holders are in emanate danger of being called out by the GP, but NRP’s common unit holders do have less representation and recourse through NRP than they would as shareholders of a typical public company. The NRP GP is entirely controlled by Mr. Robertson Jr. and his various related corporate entities, he unilaterally appoints board members, and has the right to call common unit holder shares under the parameters already discussed.

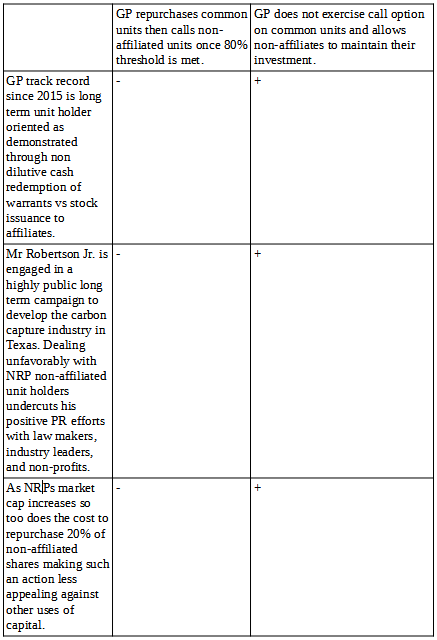

Because Mr. Robertson Jr. has such an out-sized impact on NRP common unit holders, it’s worth reviewing his track record to see if any insight can be gained into his management style and motivations. To do this, we’ve created an Analysis of Competing Hypothesis Chart (ACH). We detailed the benefits of the ACH in Episode 55 as part of our review of Richards J. Heuer’s book The Psychology of Intelligence Analysis.

ACH charts are beneficial tools that help intelligence analysts organize their thoughts about the likelihood of occurrence of unknowable future events. The ACH is essentially a matrix of known facts and possible outcomes arrayed on an x-y axis. One axis of the ACH lists possible future outcomes and the other axis lists known facts that relate to the topic in question. At the intersection of any given fact and its potential outcome the analyst places a plus if the fact supports that outcome and a negative if it negates that outcome. Looking across the chart allows the practitioner to see, at a glace, which hypothesis is “the least wrong.”

Looking for the least incorrect hypothesis is important as a single piece of information can invalidate a hypothesis where a million supporting facts can never fully prove that an outcome is certain. The ACH example from Episode 55 investigates the then unknown outcome of Cleveland Cliffs’ royalty dispute with Mesabi Trust and was useful in our decision to invest in Mesabi Trust at that time.

ACH with respect to Mr. Robertson Jr.

Based on the above ACH, it appears unlikely that Mr. Robertson Jr., as the GP, will force the affiliated shareholders to call the shares of the non-affiliated shareholders even if they have met the 80% ownership threshold required to exercise the option. This is, of course, no guarantee as the future can never be known in advance but it should serve as a useful guide to investors calculating the probability of their investment being called away at the worst possible time. Additionally, even if the GP intends to exercise his call option on non-affiliated shares, non-affiliated unit holders can track the slow rise in GP and affiliate ownership of common units over time and exit their investment prior to the 80% threshold being met, if desired.

As a related aside, the following link will take you to an interview with Mr. Robertson Jr. that’s useful for both understanding his objectives for NRP as well as the future of the carbon capture industry (LINK).

Conclusion

Once again, we can’t say enough how much we benefit from the thoughtful engagement of our audience. Answering this single question about NRP’s corporate risks led us to a much deeper understanding of the investment and forced us to examine our own blind-spots which is what the investing game is all about. We truly hope that you’re gaining as much insight from our shared research as we’re gaining from your engagement with us and we look forward to our next episode of the podcast.

On that note I’d like to let you now that we won’t be putting a show out on Saturday December 30th but instead will be spending time with family and friends and reflecting on the year to come. We hope that you too will take some time to reflect this holiday season and that you come back refreshed and ready to invest in 2024. Thanks again and we will see you again on Saturday January 6th. Have a great holiday week!

Share this post