Welcome to Episode 103 of the show where we will share another actionable investment write-up with our amazing audience.

Grayscale Bitcoin Trust

Grayscale Bitcoin Trust is a closed end fund that offers investors the ability to purchase publicly traded shares on the OTCQX Market. Each of the 692,370,100 shares outstanding represent a claim on 0.00089744 of a bitcoin. The fund offers investors several advantageous over purchasing bitcoin directly to include the ease of owning bitcoin without the difficulty of self storage, the ability to purchase GBTC shares in a brokerage account, and the simplicity of record keeping and taxes that goes with owning an established publicly traded security versus self custody of a crypto asset. As with anything, however, there are also disadvantageous to GBTC’s fund structure.

The Arbitrage

The primary disadvantage to owning GBTC lies in the closed end nature of the fund itself. Because the fund follows a closed end structure new shares cannot be issued or redeemed and the shares themselves trade at a premium to net asset value (NAV) or a discount to NAV depending on supply and demand in the market. Exchange traded funds (ETFs) eliminate this problem by allowing new shares of the fund to be issued or retired based on market demand for the underlying asset.

This concept is worth an illustration as understanding it is not intuitive. Imagine you owned one hundred 1 oz gold bars and you set up a fund where each of the 100 shares represented one of the 1 oz bars. With the market price of gold being $2,000 dollars per ounce you would assume that each share in your fund, which represents one 1 oz gold bar, would trade for $2,000 dollars. If, however, you did not offer shareholders the ability to redeem their shares for physical gold, then you might see shares in your fund trade well above the value of an ounce of gold or well below the value of an ounce of gold due to investor sentiment and demand for the shares.

Investors who were bullish on the price of gold might purchase a share in your fund at a price 10% over the price of physical gold assuming that if gold rose by more than 10% they would still prophet despite over paying. Likewise, investors with a bearish sentiment might sell a share 10% below the fair market price thinking they would still come out ahead if gold fell by more than 10% in the near future. Because the share can not be exchanged for the physical asset, the price of each share is free to float above and below the actual price of the commodity it represents without a correcting mechanism.

If you convert your fund to an ETF that allows for share issuance and share redemptions wherein the redemptions are settled with the physical commodity, however, then you eliminate the price differential between your fund’s shares and the physical commodity. Essentially, the price difference between the fund’s shares and the physical commodity are arbitraged away in the following manner. Assume that a share of the fund can be purchased for $1,900 and then redeemed for an ounce of gold worth $2,000. A savvy investor would purchase a share in the fund, redeem it for the underlying commodity, and then sell the commodity for cash and realize a $100 dollar profit on the difference. The process works the same when fund shares are overvalued and investors can sell the commodity to the fund in exchange for a share worth more than the commodity they just delivered. Arbitrage working in both directions pushes the share price and the price of the underlying commodity closer together whenever they’re out of alignment. This is basic supply and demand.

The process just described is exactly the same process that keeps existing ETFs in line with whatever underlying asset that they represent. Authorized Participants (APs) who represent large amounts of institutional money are granted the ability to arbitrage the price differential between the ETF shares and the underlying asset they represent and this arbitrage prevents the deviations between price and NAV that are so common among closed end funds.

Grayscale, the company that operates GBTC, is aware of the price-to-NAV disparity inherent to closed end funds and as such has spent years pursuing SEC approval to convert GBTC into an ETF. The process began in October of 2021 when Grayscale applied to the SEC for approval to convert. The SEC denied Grayscale’s application and a back and forth court battle ensued continuing through August 29th of this year when the D.C. Circuit unanimously ruled in favor of Grayscale’s request to uplist. The SEC elected not to appeal the court’s decision and on October 19th Grayscale resubmitted its ETF application to the SEC. At this point ETF approval appears to be a matter of when not if and other large financial institutions to include Blackrock, Fidelity and others have submitted there own bitcoin ETF applications.

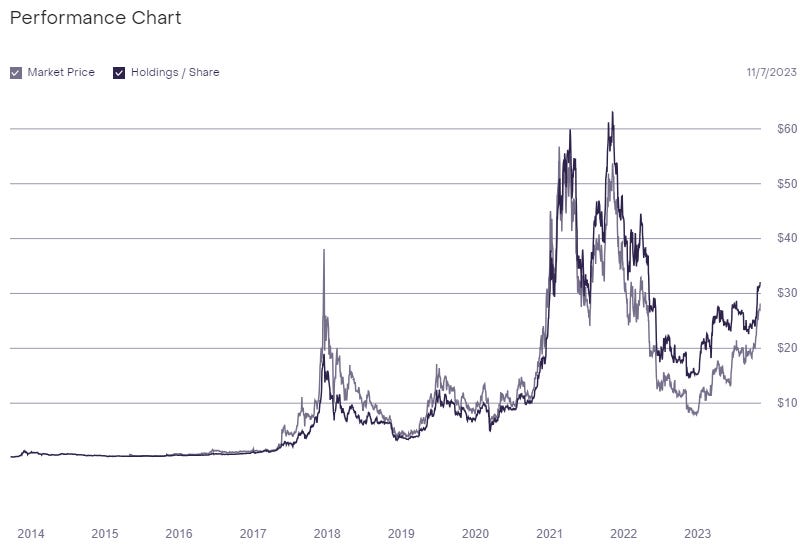

Getting back to GBTC specifically. The fund currently trades at a 14% discount to NAV up from a nearly 50% discount in December of last year. Over the life of the fund GBTC has at times traded at a premium to NAV and a discount to NAV as indicated by the chart below but once the fund converts to an ETF the arbitrage mechanism described above will forever erase that disparity. Given that the fund currently trades at a discount to NAV, and that ETF approval is closer today than it has ever been, GBTC shares offer investors an easy arbitrage situation between now and day the fund converts.

The Bitcoin Halving

The second near term driver to GBTC’s price appreciation comes from the bitcoin protocol itself. This driver comes in the form of the halving which we covered in Episode 75 but that we will briefly review again here.

Bitcoin was launched in 2009 via a decentralized open source protocol. Those who chose to voluntarily devote their computing power to validating bitcoin are known colloquially as miners and their collective computing power simultaneously secures the bitcoin network and competes for block rewards. Block rewards are new coins issued to whichever miner’s computer guesses the correct answer to a mathematical question unique to that specific ten minute block of transactions. Rewarding miners with newly issued coins incentivizes them to devote computing power to the network and increasing computing power devoted to the network makes the network more secure for participants.

Each miner is voluntarily participating in the decentralized and open source bitcoin protocol and as such has agreed to the rules of governing the network. This is what makes the network so secure in that any user or miner could at any time decide to violate the rules of bitcoin but in doing so their ledger of information would be immediately rejected by the remaining majority of users who chose to adhere to the protocol. In the centralized systems that we’re all most familiar with, the individual in control of the system has all of the power such that a hacked banking network is completely under the control of the person or group who hacked it but not so with bitcoin. In bitcoin the majority rules and any individual who changes the rules is rejected by the majority thus incentivizing network cooperation rather than network attacks.

Getting back to the topic of the halving, the bitcoin block reward was set at 50 coins per ten minute block at the beginning of bitcoin’s existence. At the first halving in 2012 the block reward dropped to 25 coins per ten minute block. The 2016 halving saw the block reward fall to 12.5 coins per ten minute block cycle and in 2020 the reward fell again to just 6 ¼ coins per block. In March of 2024, the block reward will again fall to just 3 1/8 coins per block and this is the second near term catalyst behind GBTC’s pending price appreciation.

To understand why the halving drives the price of bitcoin consider the fact that all businesses take into account their cost of goods sold in order to stay profitable. If you decided to sell eggs from your backyard chickens you would take into consideration the cost of feed, water, shelter and any other input costs to your chicken. You would divide your total chicken input costs by the number of eggs that the chicken could produce so that you knew your per-egg cost of production.

If for some reason the number of eggs produced by your chicken each day were cut in half and nothing you could do would increase the amount of eggs laid to previous levels then your cost to produce each egg would be double what it was before. This is because your input costs to produce each egg would remain the same but the number of eggs produced was cut in half. This cost of goods sold increase is exactly what happens to bitcoin at each halving event.

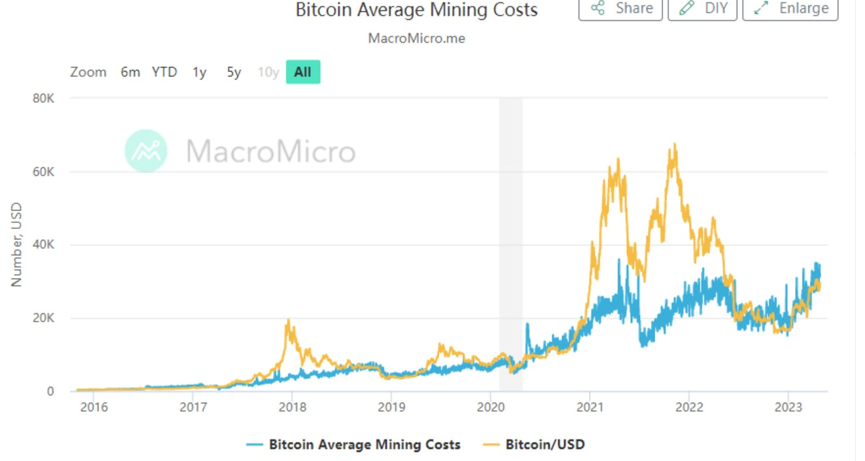

Bitcoin miners have fixed costs in the form of energy and computer equipment that when divided by the number of bitcoins that the equipment and energy will produce represent their cost of goods sold. When the bitcoin block reward is cut in half the miners cost to produce a new bitcoin is doubled. Because no business person, including a bitcoin miner, can afford to sell their product below the cost of goods sold, the lowest price at which a miner is willing to sell his product is doubled every four years at the halving. The chart below shows the cost of mining over time in blue and the spot price per bitcoin in orange. It’s interesting to note that the spot price of bitcoin rarely trades very far below the average mining cost and when it does it doesn’t stay their for an extended period. This is because miners are economically incentivized to sell their newly minted bitcoin above their cost of production.

With bitcoin trading near its production cost of 35K at the present time we can assume that if the halving occurred tomorrow the cost of production per coin would rise to 70K per coin. If at the same time GBTC converted from a closed end fund to an ETF, then the 14% discount applied to the funds shares would also be arbitraged away and would see the GBTC share price trade in line with the bitcoin spot price.

Assuming that an investor purchased a bitcoin worth of GBTC shares for $30,000 today that represented a claim on a full bitcoin worth of assets valued at $35,000 in the spot market, then following the halving and the ETF conversion that $30,000 investment would appreciate to $70,000 for a 133% return. These numbers, of course, are just examples as nobody can know in advance what bitcoin’s post halving price will be but they do serve to demonstrate the powerful effect that both catalysts could have on GBTC’s appreciation going forward.

The eventual conversion of GBTC from a closed end fund to an ETF seems highly likely at this point even if the exact timing of the event is unknown. The approaching halving event in March of 2024 is a certain event and the timing is precisely known which means that a significant return is available to anyone purchasing shares in GBTC today and only one variable, the timing of ETF conversion, is unknown at this time.

Bitcoin’s Future

For the holdouts that remain bitcoin skeptics, I’d first like to thank you for making it through a podcast that must sound ridiculous to you. Next I’d like to encourage you to reconsider your position with an open mind. Strip away your preconceived notions about the word bitcoin and reflect on the fundamentals surrounding the technology.

Humanity now has access to a technology that keeps perfect account of global transactions, maintains 24/7 operations, and is decentralized and unhackable. The genie is not going back in the bottle. The technology is here to stay and all that remains to be seen is how it will be integrated and on what timeline.

Referred to by Jamie Dimon, CEO of JPMorgan Chase, as a “pet rock” as recently as January of this year, bitcoin has historically been derided by financial insiders. Buffett and Munger are equally critical of the technology with Munger himself referring to bitcoin as “rat poison” and yet despite the old guard’s criticism the bitcoin network continues on uninterrupted slowly winning over ever larger swaths of the mainstream. It’s interesting to note that Munger’s own law firm Munger, Tolles & Olson is Grayscales legal council in their battle against the SEC.

Along the same line Larry Fink, CEO of BlackRock, had the following to say about bitcoin’s recent price rally.

I think it’s just an example of the pent-up interest in crypto. We are hearing from clients around the world about the need for crypto.

I think some of this rally is way beyond the rumor. I think the rally [on Monday] is about a flight to quality with all the issues around the Israeli war now, global terrorism and I think there are more people running into a flight to quality whether that is in treasuries, gold or crypto – depending on how you think about it.

And I believe crypto will play that type of role as a flight to quality.

Fink, is as establishment as they come and his recent statement along with Blackrock’s own application to create a bitcoin ETF demonstrates that bitcoin’s inexorable march forward into the financial mainstream continues.

The skeptics might accept that bitcoin adoption is growing but still claim it’s tulip mania, that it has no value. The value, however, is largely linked to the halving which we covered earlier in the podcast. Every four years the issuance of new bitcoin is cut in half until the year 2140 when the last bitcoin will be minted. A currency with a fixed supply will naturally grow in value against a currency with an expanding supply.

Today, a bitcoin can be purchased for around $35,000 but imagine an extreme world where the supply of dollars was expanding by one trillion dollars per day. Against a dollar supply expanding at that rate it would take far more than $35,000 dollars to buy a single bitcoin for the obvious reason that purchasing a scarce and fixed item using non-scarce and expanding currency will cost more and more money as the money supply grows. The number of dollars required to purchase bitcoin is growing because the proportion of dollars relative bitcoin is continually expanding.

Conclusion

The arbitrage opportunity in GBTC’s ETF conversion alone constitutes a special situation and warrants investor attention but the long term case for bitcoin offers even greater upside. If you find yourself dismissing bitcoin based on superficial arguments or preconceived notions we urge you to pause and take a deeper look. One thing is for certain, bitcoin ETF approval will only occur once and you still have time to take advantage of that fact. Delay your deeper dive into bitcoin and you may find yourself converted to a bitcoin believer after the opportunity has passed. In a world primed for currency debasement, technology has provided individuals with a first, the ability to opt out. It would be wise for each of us to give the appropriate consideration to this opportunity.

With that we hope that you learned something from today’s write up. As always we’d like to thank you for your support and your engagement. We look forward to bringing you another actionable investing write up again next week.

Post Script

Check out this article about CME Group becoming the top bitcoin futures trading exchange, replacing Binance.

This in another example of the power and versatility of the exchange business model. If interested in more, check out our piece on CME Group here.

Share this post