Welcome to Episode 113 of Special Situation Investing.

At times I have enough cash flow coming in to steadily buy stock in my newest idea. Other times new cash is harder to come buy and my purchasing of new stocks slows down. In still other circumstances, I’ll get a large cash infusion all at once and wonder how best to deploy it. Should I dollar cost average the lump sum into my top investment ideas or quickly establish a new or significant position in whichever company I happen to be buying at that time? If I build a big position all at once, following an infusion of new money, I run the risk of the stock declining in the short term leaving me wishing I’d moved more slowly.

These are the questions that I’ve been reflecting on over the last several weeks. Maybe it’s the way I’m wired or maybe it’s innately human to look for paint-by-number systems but I was sure there must be a method that, if uncovered, would lay out a clear and mechanistic answer to my dilemma. My thoughts, as they often do, turned to Warren Buffett and how he would handle the situation.

Thesis

In thinking the problem through, I theorized that Buffett must have slowly bought into new long-term positions over months, and even years, to reduced the odds of his position declining significantly in value after his initial purchase. I supposed that my thesis would be proven correct based on all of my prior studies of the master at work. Like many of you, I’ve read all of the letters, listened to the annual meetings, and read all the biographies. I seemed to remember Buffett being slow to build into his positions. Based on my recollection, his American Express, Washington Post, and Coke investments were all built up over extended periods of time and I assumed that that is the way I should build new positions as well if I hoped to travel the same road.

Findings

In an attempt to validate my thesis, I went back to the partnership letters and began to re-read them for the first time in years. As far as I can tell my thesis was incorrect. I couldn’t find any evidence to support my belief that Buffett purchased stocks in a systematic way. To the contrary, he seems to have been hyper-focused on identifying one or two great ideas and then pouring into them as quickly as possible without regard for any preconceived notion of how much cash to hold or the rate at which he should buy.

Buffett showed no concern for portfolio construction, dollar cost averaging, or any number of things that occupy the minds of most investors. Rather he seemed to focus entirely on finding a few great investments and moving as much capital into his best ideas as possible.

This drove me to wonder what Buffett would be focused on if our positions were reversed. How would he structure my investments and what would he focus on if he spent a day, a month, or even a year in my shoes?

Lessons

Because switching places with Warren and observing him managing my investments is impossible I figured that the next best thing would be to observe his behavior when he was in a similar place along his journey. Now because he started so early in life and was such a good capital allocator I couldn’t simply observe what he was doing at my age. At my age he was managing hundreds of millions and running a large company and I’m doing neither of those things. No, instead of comparing myself to him at the same age I have to compare myself to him at a similar net worth. Comparing myself in this way helps me to draw more relevant lessons that can be more readily applied to my own processes.

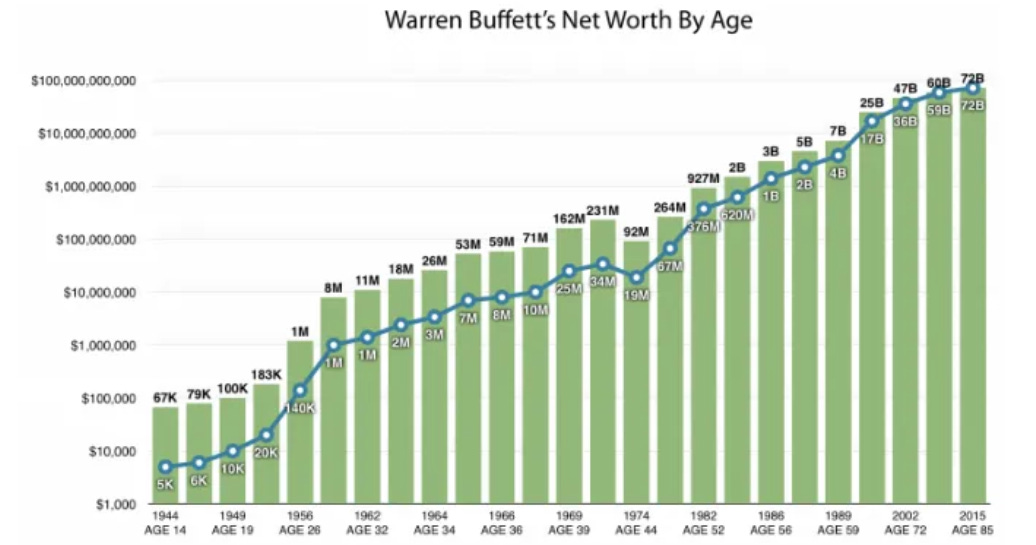

Using the chart below, any one of us can figure out where we are on the Buffett timeline and then compare his methodology and focus at that time with our own processes to try and tease out some useful lessons. For the purpose of this example lets use a generic net worth in the single digit millions range that likely pertains to most of our listeners.

If we look closely at the chart we can see that Buffet’s net worth at age 26 was around $140,000 dollars. The year was 1956 and according to the chart that amount adjusted for inflation comes out to roughly $1,000,000 dollars. By the time he turned thirty his inflation adjusted new worth was likely over $10,000,000 which is why, for the purposes of this discussion, we will assume that his personal net worth, inflation adjusted, in his late twenties was in the single digit millions range.

A few points about the limitation of the chart above and the numbers presented. I didn’t create the chart but my cursory review of it seems to line up with what I know of Buffets history. Additionally, inflation is notoriously tricky to calculate. I re-ran the numbers above in a separate online inflation calculator which gave a current value of $1.5 million for $140,000 1956 dollars instead of just $1 million. I believe the chart was created in 2016 and so the last few years of higher inflation may be the reason for the discrepancy. In any case, I think the graph, imperfect as it is, represents a useful enough tool for the thought exercise that we’re engaged in.

Typical Situation

Perhaps by reviewing what Buffett referred to as a typical situation in his 1958 partnership letter we can draw some useful lessons learned that apply to someone of a similar inflation adjusted net worth today. Before we jump in to the 1958 example, it’s worth noting that Buffett was managing about $500,000 of other people’s money in 1956 which adjusted for inflation in 2023 is equivalent to around $5.6 million. So the following partnership letter comes from a man in his late twenties with today's equivalent of more than a million in net worth who’s managing over six million dollars for others. Buffet wrote:

So that you may better understand our method of operation, I think it would be well to review a specific activity of 1958. Last year I referred to our largest holding which comprised 10% to 20% of the assets of the various partnerships. I pointed out that it was to our interest to have this stock decline or remain relatively steady, so that we could acquire an even larger position and that for this reason such a security would probably hold back our comparative performance in a bull market.

This stock was the Commonwealth Trust Co. of Union City, New Jersey. At the time we started to purchase the stock, it had an intrinsic value $125 per share computed on a conservative basis. However, for good reasons, it paid no cash dividend at all despite earnings of about $10 per share which was largely responsible for a depressed price of about $50 per share. So here we had a very well managed bank with substantial earnings power selling at a large discount from intrinsic value. Management was friendly to us as new stockholders and risk of any ultimate loss seemed minimal.

Commonwealth was 25.5% owned by a larger bank (Commonwealth had assets of about $50 Million – about half the size of the First National in Omaha), which had desired a merger for many years. Such a merger was prevented for personal reasons, but there was evidence that this situation would not continue indefinitely. Thus we had a combination of:

1. Very strong defensive characteristics;

2. Good solid value building up at a satisfactory pace and;

3. Evidence to the effect that eventually this value would be unlocked although it might be one year or ten years.

If the latter were true, the value would presumably have been built up to a considerably larger figure, say, $250 per share. Over a period of a year or so, we were successful in obtaining about 12% of the bank at a price averaging about $51 per share. Obviously it was definitely to our advantage to have the stock remain dormant in price. Our block of stock increased in value as its size grew, particularly after we became the second largest stockholder with sufficient voting power to warrant consultation on any merger proposal.

Commonwealth only had about 300 stockholders and probably averaged two trades or so per month, so you can understand why I say that the activity of the stock market generally had very little effect on the price movement of some of our holdings.

Unfortunately we did run into some competition on buying, which railed the price to about $65 where we were neither buyer nor seller. Very small buying orders can create price changes of this magnitude in an inactive stock, which explains the importance of not having any "Leakage" regarding our portfolio holdings.

Late in the year we were successful in finding a special situation where we could become the largest holder at an attractive price, so we sold our block of Commonwealth obtaining $80 per share although the quoted market was about 20% lower at the time.

It is obvious that we could still be sitting with $50 stock patiently buying in dribs and drabs, and I would be quite happy with such a program although our performance relative to the market last year would have looked poor. The year when a situation such at Commonwealth results in a realized profit is, to a great extent, fortuitous. Thus, our performance for any single year has serious limitations as a basis for estimating long term results. However, I believe that a program of investing in such undervalued well protected securities offers the surest means of long term profits in securities.

I might mention that the buyer of the stock at $80 can expect to do quite well over the years. However, the relative undervaluation at $80 with an intrinsic value $135 is quite different from a price $50 with an intrinsic value of $125, and it seemed to me that our capital could better be employed in the situation which replaced it. This new situation is somewhat larger than Commonwealth and represents about 25% of the assets of the various partnerships. While the degree of undervaluation is no greater than in many other securities we own (or even than some) we are the largest stockholder and this has substantial advantages many times in determining the length of time required to correct the undervaluation. In this particular holding we are virtually assured of a performance better than that of the Dow Jones for the period we hold it.

With that example fresh on our minds and armed with a knowledge of the amount of capital Buffett was working with at the time, what lessons can be drawn? I think there are a few things we can learn and that it might be best to focus first on what Warren wasn’t focused on and then move to what he was focused on.

What Buffett Didn’t Focus On

Starting off, what wasn’t Buffett focused on when he wrote that letter in 1958? To begin, he didn’t appear to be concerned by global macro events. We can see by reviewing newspaper headlines in the years leading up to and including 1958 several major events took place in the world. There was a revolt against Soviet control in Hungary, the Suez Canal crisis, and the launch of the first man made satellite to name just a few. It’s easy to imagine an investor at the time fretting over supply chain disruptions, geopolitical risks, and any number of other factors that were all outside of their control. Rather than fretting, however, we see Buffett zeroed in on a few very specific investments and the limited factors that directly to those investments.

Additionally, Warren did not appear concerned with large cap stocks. In fact, if you review the 1958 Fortune 100 list you’d be hard pressed to find a single company listed that the Buffett partnership held. This seems to indicate that Buffett considered his small pool of capital an advantage and stuck to areas in which that asymmetric advantage could be applied.

Taking this point further we see that Buffett himself discussed the value of their position as being greater than market value because it was the second largest block of stock owned by any of the bank’s shareholders. In fact the size of the partnerships position is probably the reason why he was able to sell it at a valuation 20% greater than the market when a new opportunity presented itself. Buffett was running a relatively small partnership at a young age and yet we see him taking significant positions in small thinly traded companies which turned his small size into a great advantage.

What Buffett Did Focus On

Moving now to what Buffett did focus on we can observe the following. He had a well defined conception of the intrinsic value of whatever he set out to purchase. He states that he believes the value of the stock is $125 and that he was able to buy it for $50. To be clear this wasn’t a price target as is commonly used in the industry but rather an understanding of the companies intrinsic value. The difference is made clear when Buffett mentions that the holding period could be from one to ten years but that the value of the company on a per share basis might increase to $250 at the end of that period. Again, you can see that he has a clear formulation of the value of what he’s purchasing before he establishes the position and that the value adjusts over time.

Related to the above point, he was an absolute stickler about the price paid for a stock. This is made clear when he highlights the difference between a $50 stock purchase with an intrinsic value of $125 and an $80 dollar stock purchase with an intrinsic value of $135. His precise estimation of a stocks intrinsic value coupled with his refusal to overpay was a combination that most certainly enhanced his returns over the years.

Another thing we observe about him is the deep knowledge he developed pertaining to his specific investments. He knows the management, has an awareness of other shareholders, and can explain details concerning future merger possibilities and why past attempts may have failed. This understanding of the company goes far beyond public filings and P/E ratios and illustrates that, while he had no opinion on macro factors outside of his control, he maintained an intimate knowledge of the investments that sat smack in the middle of his circle of competence.

A final lesson we see is that of opportunity cost. Munger discussed opportunity cost publicly more than Buffett does but we see Buffett’s understanding of the concept illustrated by his decision to sell the partnerships bank investment in favor of his new best idea. The idea behind opportunity cost is that you measure all opportunities against your best option and use that to screen out the things that don’t deserve your attention or your investment dollars. In typical Munger fashion, he describes opportunity cost as follows:

Opportunity cost is a huge filter in life. If you’ve got two suitors who are really eager to have you and one is way the hell better than the other, you do not have to spend much time with the other. And that’s the way we filter out buying opportunities.

Personal Application

So how does all of this fit together?

I started out with a theses that Buffett built up new stock positions slowly and mechanistically but discovered that wasn’t the case. By revisiting the partnership letters at a time when Buffett’s net worth was much closer to us mere mortals, I was reminded that, in Warren’s own words, he focuses on “things that are knowable and things that are important.” Whether or not the Fed raises interest rates a year from now is important but not knowable. What the price of gold did over the course of any single day is knowable but not important. Yet how often do we find ourselves preoccupied by things that are neither knowable nor important?

I began this thought experiment in search of a mechanistic approach to buying into new positions that would account for lumpy inflows of new capital. Should I dollar cost average into the position or go big right from the start as new money became available? What I learned, or perhaps relearned, by studying Buffett at the outset of his career was that he played a non-mechanistic game.

Buffett focused completely on finding the next great opportunity and moving into it in as big a way as possible without regard for systems. He identified opportunities by spending the limited time he had studying what was knowable and important while largely ignoring the rest. He formulated a clear idea of intrinsic value in his mind and then refused to overpay. He then used opportunity cost as a framework to constantly move capital from his worst ideas into his best such that he could maximize his returns.

Conclusion

In conclusion, I was happy to have destroyed another one of my own misconceptions through the course of this little essay. Munger was famous for stating that “any year that you don’t destroy on of your best-loved ideas is probably a wasted year.” So on the upside it’s only January and already 2024 won’t be wasted.

As always, we’ll be back with another episode next week. We hope that you’re enjoying the show and learning alongside us. Your feedback and interaction are much appreciated as are any boosts you send our way on the fountain podcasting app.

Thanks and we’ll see you again next week.

Share this post