Welcome to Episode 100 of Special Situation Investing. (Wow…100!)

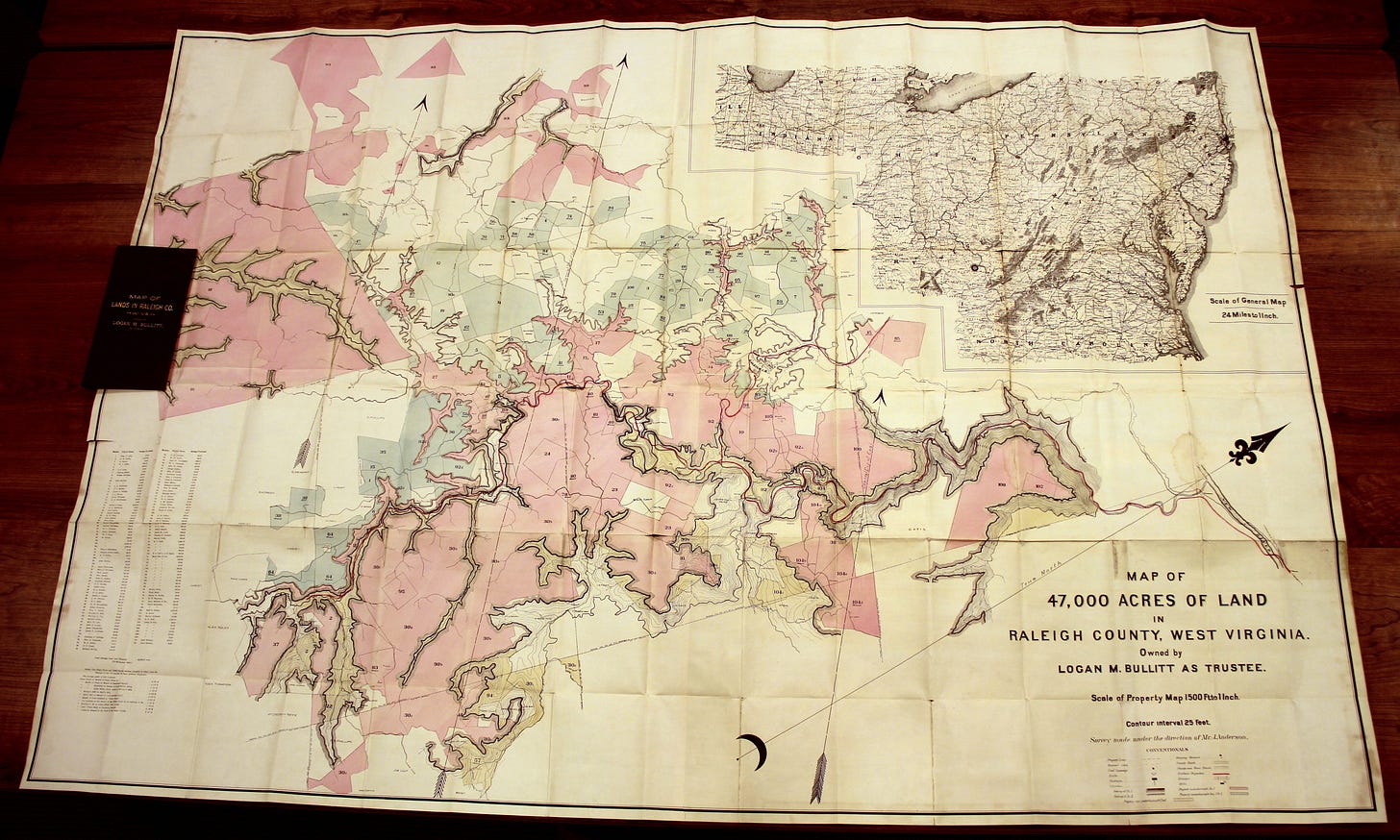

A hand-colored map bearing the title Map of 47,000 Acres of Land in Raleigh County, West Virginia, Owned by Logan M. Bullitt as Trustee was recently cataloged in the Earl Gregg Swem Library Rare Books Collection. A relic from the late 1800’s, the map is part of a colorful tale behind a fascinating company.

In 1889, a farmer from Raleigh County, WV, named Azel Ford understood the value of the coal under the ground he and his neighbors owned. With the pluck and luck of a speculator, Ford procured legal options to thousands of acres and went to Philadelphia and New York City hunting for buyers. Three prominent businessmen of the day—Anthony Drexel, Logan Bullitt and J.P. Morgan—bought everything Ford had and sent him back to purchase them more. Which he promptly did. Because of a West Virginia law that prevented a single corporation from owning more than 10,000 acres, the land Ford bought was separated between a handful of companies. Upon the law’s repeal in 1902, the land was consolidated into one entity—the Beaver Coal Company.

The Company

One hundred and thirty-four years later, Beaver Coal Ltd is a dark, illiquid master limited partnership that trades on the OTC Pink Sheet market. To top it off, the company name contains the word coal. If all that’s not enough to turn you off, perhaps you, like us, are interested in a deeper look.

Today, the company still owns the surface and mineral rights to approximately 50,000 acres within a 10-mile radius of Beckley, West Virginia. Here’s how the company describes itself and its history:

In 1889, Anthony Drexel, Logan Bullitt and J.P. Morgan, three prominent men from Philadelphia, PA, and New York, NY, sent their land agent, Azel Ford, to Raleigh County, WV, to purchase approximately 50,000 acres of property in and around the Beckley area. The acquired property was later placed under the administration of [Beaver Coal] to manage the affairs of the company.

During the first 100 years, [Beaver Coal’s] primary source of income was generated through the leasing of its coal reserves to coal mining companies, and the sale of its timber. [Beaver Coal] has never mined or sold a single pound of coal, nor has it cut any timber from its property. Timbering and mining activities on [Beaver Coal’s] property have always been carried out through lease agreements with separate and distinct operating companies.

As time passed, [Beaver Coal] began to lease portions of its surface property. Starting with farming or other individual purposes, the company eventually expanded into leasing for commercial and recreational purposes.

Today, [Beaver Coal] is a limited partnership whose partnership certificates are traded on the OTC market under the symbol BVERS. Two of the six current directors are descendants of the original founders of the company. Recognizing that coal and natural gas are depleting resources, [Beaver Coal] has in recent years worked with operating companies to generate an increasing share of rental income from residential homesites, mini-storage facilities, tourist cabin rentals and other commercial development.

What most investors would write-off as an undesirable coal company actually appears to be a capital-light land owner. In fact, although the company maintained its legal name as Beaver Coal Ltd, in 2018, it began doing business as (dba) Beaver Land Company, and then in 2021, as Beaver Property Company. This unofficial transformation of the name reflects the ongoing transformation of the company’s revenue streams.

Revenue Streams

For over a century, Beaver derived its revenue solely from coal royalties and, to a lesser extent, timber sales. That trend was broken in the early 2000s when management began developing income through oil and gas royalties, rent from commercial and residential properties, and most recently, stone royalties and methane gas royalties.

With data collected from its annual reports and annual letters, we were able to look back through 2015 and compared its revenue sources then to today’s. The pie charts below depict what we found.

At first glace, it appears Beaver (just like the nation of Germany) has struggled to quit coal. Beaver derived 42% of its income from coal in 2015 and 67% in 2022. Part of the reason coal commanded such a high percentage in 2022 was extraordinarily high coal prices. That said, even barring record prices, the majority of revenue came from coal every year for which we had records.

A deeper look shows that management is having success in diversifying its revenue streams. While rental income decreased on a percentage basis from 38% to 21%, the nominal value increased 50% from approximately $2 million to $3 million. The charts also show the addition of two new income streams in 2022, stone royalties and methane royalties. Taken all together, it does appear management is successfully diversifying its income streams.

Now let’s take a deeper look at what’s behind each of these revenue streams. We’ll take them in order from smallest percentage to largest.

Stone Royalties

Beaver’s smallest revenue source is its stone royalties. These are royalties the company collects off of sales of stone from the quarry located on its property. Up through 2021, the quarry was left inactive by its operator and Beaver only received a minimum royalty of $25,000 each year. In 2019, a new tenant took over the quarry lease and Beaver received its first royalties in the amount of $106,164 in 2022. Stone royalties currently make up 0.7% of Beaver’s revenue.

Natural Gas Royalties

Natural gas royalties come in next netting Beaver $167,968 of revenue in 2022. Natural gas consistently makes up a small portion of Beaver’s revenue, rising and falling with the price of the commodity. The last wells drilled on Beaver’s land were completed in 2006. The number of operating wells has been slowly decreasing as each reaches the end of its useful life. As Beaver’s land is not suited for hydraulic fracturing, this has led operators to drill in other parts of the country. In 2022, there were 123 wells still in operation on Beaver’s land and natural gas royalties made up 1.2% of revenues.

Methane Royalties

The next largest source of revenue is a new one for Beaver. In 2021, the company entered into royalty agreements with a methane gas capture firm. The firm flares off methane produced at the active coal mines on Beaver’s land for which they receive carbon elimination credits. These credits are then sold and Beaver receives a royalty on those sales. In 2022, Beaver’s share of the profits amounted to $216,358 representing 1.5% of revenue.

Timber Royalties

Revenue from timber sales has been a staple for decades. Like all of its activities, Beaver’s role is limited to leasing out property to operational companies who harvest the timber and pay royalties. To take advantage of the volatility in timber prices, management actively throttles the amount of timber harvested to each year, harvesting more when prices are high and less with softer prices. At the same time, they carefully manage their timber lands with a sustainable yield program to preserve the renewable revenue source for the future. In 2021, management purchased 675 additional timber acres. As a testament to their ability to spot a good deal, the initial sustainable cut in the new acres nearly paid back the entire purchase price of the investment. On the back of higher volumes and higher prices, timber royalties in 2022 were a near record of $1,172,241 representing 8.2% of total revenues.

Rental Income

The rentals category is Beaver’s second largest revenue stream and one of its most consistent. Rental income comes from commercial and residential properties including mobile home parks, storage facilities, utility easements and a cabin rental company called The Cabins at Pine Haven. Management’s strategy is once again capital-light in that they rent property to entities that construct their own buildings, simplifying Beaver’s role to that of only land lessor. In 2022, income from this segment of the business amounted to $3,032,528 or 21.1% of total revenue.

Coal Royalties

As mentioned earlier, coal royalties consistently claim the largest slice of Beaver’s revenues and 2022 was no different. Well, it was different in that it was a record year for coal revenue. Beaver profited handsomely from the runup in coal prices during the energy crunch of 2022, raking in $9,677,437 on both higher prices and higher output by the mine operators.

Beaver owns deposits of the highest-grade metallurgical coal used as coking coal in the production of steel, not the grade of coal used in power plants. Metallurgical coal is sold to steel mills in the United States and overseas, particularly those located in Asia.

The coal produced on Beaver’s land comes from two active mines each operated by a separate company. The first company is Arch Resources and its mine is called the Beckley Mine. The following description of its operations at the Beckley mine was found in its most recent annual report:

The Beckley mining complex is located on approximately 16,600 acres in Raleigh County, West Virginia. Beckley is extracting high quality, Low-Vol metallurgical coal in the Pocahontas No. 3 seam. The Beckley mining complex had approximately 19.6 million tons of proven and probable reserves at December 31, 2022. Coal is conveyed from the mine to a 600-ton-per-hour preparation plant before shipping the coal via the CSX railroad.

The second active mine is the Affinity Mine. This mine was closed in the 1980s until about 2010 when the mine was bought by United Coal Company, a subdivision of Metinvest, a Ukrainian-based international, vertically integrated mining and steel company.

Both the Affinity and Beckley mines on average produce roughly one million tons per year.

The Business Model

We were encouraged to see , with the exception of the occasional land sale, all of Beaver’s revenue sources are royalty or rent-based. What this creates is a capital-light business based on inflation-beneficiary income sources. As a consequence, the company operates with little to no capex and minimal opex. While we weren’t able to ascertain the exact number of employees at Beaver, the company only has three officers—a president, a vice president/secretary and a vice president/treasurer—as well as three additional board members. We were happy to see management reiterate its commitment to maintaining a capital-light structure in every annual report. Here’s how they stated it in 2022:

We will continue to monitor operating expenses, which remain low. Our principal goal is to maintain our overall operating margin and provide consistent limited partner distributions. As we have stated in the past, we believe in the conservative long-term management of our commodity assets through the retention of qualified operators under lease to Beaver. This, combined with the prudent development of our surface property, stone quarry and timber holdings are managed to create a consistent and diversified lease income stream for the long-term benefit of our limited partners. Development, however, will not cause us to rapidly grow administrative expenses or to assume business risk which is best undertaken by tenants under lease.

To determine how successful management has been at increasing revenue, maintaining low opex, and providing partner distributions, we created the bar graph shown below. Revenue and opex are plotted against the left scale (in dollars) and dividends against the right scale (also in dollars).

The chart clearly shows a few things. First, since 2015 (which is a far back as our data went), opex has remained relatively flat around $2 million. There was a small increase around 2018 due to costs incurred when one officer retired and a replacement was hired. Secondly, revenue every year far exceeded opex. Third, revenue is increasing over time. And lastly, since opex remained flat, dividends generally tracked revenue.

In short, we like what we see so far with Beaver Coal (we are far from done researching this company). It checks a lot of boxes for the type of business we are looking for in the current environment i.e. it is capita-light, it has hard-asset based inflation-beneficiary income streams, management seems prudent and focused, the business model is easy to understand even if financial information is hard to come by, the company owns the mineral and surface rights to its land, the coal produced on its property is high quality met coal sold primarily to international customers.

Is It A Great Investment?

But even if it’s a great company, is it a great investment? Although past performance is no guarantee for future results, a look back in time, as depicted in the graph below, shows Beaver handedly outperformed the S&P 500. Since October 2010, Beaver increased at a CAGR of 21% compared to the S&P 500’s CAGR of 12.2%.

A review of Beaver’s stock price action shows it roughly follows the direction of the dividend payout. So the real question regarding Beaver Coal appears to be whether its dividend is sustainable and can it continue to grow. Here are a few points to consider:

Management has demonstrated its desire and ability to keep a lid on opex so there’s little risk of costs decreasing margins.

All of Beaver’s revenue streams should increase at least at the rate of inflation over time.

Management is making slow but steady progress growing and diversifying its revenue streams, but its main revenue source is still coal royalties.

Coal produced on Beaver’s land is low-vol (high quality) metallurgical coal. Beckley Mine is Arch Resource’s highest quality met coal mine and it consistently extracts about one million tons per year and currently estimates there are 19 years of reserves remaining. In 2022, Arch acquired/leased more reserves at three of its nine mines, all three were met coal, and one was Beckley Mine. So the Beckley Mine is likely a prize asset for Arch Resources.

Information regarding the Affinity Mine is more opaque. We weren’t able to find an estimate of the mine’s reserves but the Mine Safety and Health Administration has a record of the annual production output showing a decrease over the last eight years from 1.1 million to 648,000 tons produced.

Our conclusion is Beaver Coal is a company worth following and one we put on our watchlist. For full disclosure, we did buy one share in order to gain access to the company’s annual reports. We plan on doing more research on this company in the future.

Conclusion

With that we’ve wrapped up another episode of Special Situation Investing. Maybe it’s because the investigation into this company actually included a century-old map, or maybe because finding this company felt like finding a hidden gem, but this piece was extremely fun to write. We hope you enjoyed it and got something out of it as well. Given that this is our 100th episode, we are especially thankful to everyone who listens to and reads our work on weekly basis and has given your support over the last almost two years. We are thoroughly enjoying this journey and learning a lot from you guys as well. All that’s left to say is, thank you.

Share this post