Welcome to Episode 98 of Special Situation Investing.

When we wrote our first piece on Natural Resource Partners, a reader asked if we had an opinion on Alliance Resource Partners (ARLP). At the time we had none. Now we do. At first glance, the two companies have many similarities. Both are in the coal sector. Both are partnerships. Both have confusingly similar names. Closer inspection though reveals the investment strengths of each are starkly different. This piece will introduce ARLP and compare it to NRP. Along the way, we hope to highlight the merits of a topic we keep harping on—capital-light business models.

The History

In 1971, MAPCO Inc, a pipeline company, used 500,000 shares to buy a coal mine in the Illinois Basin. This mine became one of the most productive in the U.S. and its success led MAPCO to invest in more mine operations. Unperturbed by coal’s fall from grace that accelerated in the 1970s, MAPCO bought numerous thermal and metallurgical coal mines. Its coal business grew so quickly that a separate subsidiary, MAPCO Coal, was created in 1973. By the end of the 1980s, MAPCO Coal was one of the largest coal producers in the Eastern United States.

By the mid 1990s, with the slow-growth of its then mature coal business and increasing government regulations, MAPCO’s management allowed a buyout of MAPCO Coal. A separate company, Alliance Coal LLC, was formed.

Alliance Coal pursued a strategy of slow organic growth and relatively small acquisitions. At one point, it had grand ambitions to buy the coal mines of Atlanta Richfield Company in Wyoming, Utah and Colorado. If the deal had gone through, Alliance would have become the nation’s second largest coal producer. Ultimately, the deal was lost to Arch Coal.

On August 19, 1999, Alliance Coal went public as a master limited partnership and renamed itself Alliance Resource Partners. It trades on the NASDAQ Global Select Market under the ticker symbol ARLP.

The Company

Here’s how the company describes itself today, pulled directly from its 10K:

We are a diversified natural resource company that generates operating and royalty income from the production and marketing of coal to major domestic and international utilities and industrial users as well as royalty income from oil & gas mineral interests located in strategic producing regions across the United States. The primary focus of our business is to maximize the value of our existing mineral assets, both in the production of coal from our mining assets and the leasing and development of our coal and oil & gas mineral ownership. In addition, we are positioning ourselves as a reliable energy provider for the future as we pursue opportunities that support the advancement of energy and related infrastructure. We intend to pursue strategic investments that leverage our core competencies and relationships with electric utilities, industrial customers, and federal and state governments.

Our first impression is the company attempts to say it’s simultaneously a coal company and not a coal company; typical for companies in today’s ESG-influence world. While such games of verbal twister are both sad and amusing, it is true that Alliance is no longer just a coal producer.

In 2006, Alliance took an initial step in diversifying its business when it bought Matrix Design Group LLC. A market-leading provider of AI-driven proximity detection and collision avoidance solutions, Matrix's products and services include data network, communication and tracking systems, mining proximity detection systems, industrial collision avoidance systems, and data and analytics software. The system promotes safety by digitally identifying people to prevent unfortunate accidents like the recent tragedy where a woman died when a front loader unknowingly picked her up and put her in a sand crusher. The product looks pretty cool as shown in the image below.

Alliance made other diversifying investments in what it calls its “New Ventures.” The company describes these asperations in the following way:

We intend to pursue opportunities that leverage our core competencies and relationships with electric utilities, industrial customers, and federal and state governments. We have made investments of $20 million in Francis, $42 million in Infinitum and, as of December 31, 2022, $4.1 million (of a $25 million commitment) in NGP ETP IV. In 2022, revenues from these investments were immaterial.

Only the future will tell how successful these investments will prove to Alliance.

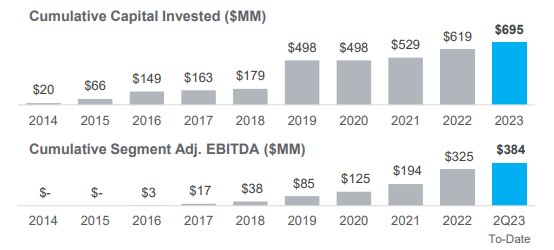

In contrast to its New Ventures, Alliance’s investments in oil and gas mineral rights have already proved quite successful. Back in 2014, Alliance slowly began allocating free cashflow to royalties with top-tier producers in the Permian Basin, primarily, with lesser exposure to the Anadarko, Williston and Appalachia Basins. As of August 2023, Alliance owned approximately 65,000 net royalty acres, of which, over half are located in the Permian Basin. Due to its capital-light nature, this section of Alliance’s business boasts a peer-leading EBITDA margin of 93%. The chart below shows a cumulative investment of $695 million has produced cumulative EBITDA of $384 million. Adjusted EBITDA of this segment in the last quarter alone was $29.1 million.

While Alliance may be trying to diversify its revenue streams, it is still primarily a coal company. This is clearly seen in that, out of $642 million of total revenue for last quarter, $610 million, or 95%, came from coal sales and royalties.

As previously mentioned, Alliance is the second largest coal producer in the Eastern United States. It ranked number five in the entire U.S. in 2022, accounting for 6% of the nation’s annual coal production. The company’s coal assets are located in the both the Illinois and Appalachia basins (68% and 32% of production, respectively) with seven underground mining complexes in IL, IN, KY, MD, PA, and WV. Alliance mines approximately 35 million tonnes of coal annually, which is a mix of both thermal and metallurgical. In 2022, approximately 82.4% of its tons were sold to domestic electric utilities and 12.5% were sold into the international markets and the balance was sold to third-party resellers and industrial consumers. Since the majority of its revenues comes from sales to domestic utilities via multi-year contracts, this allows Alliance the advantage of visibility into future cashflows. In 2023, Alliance booked contracts for approximately 97% of its production leaving the remaining 3% free to be allocated to domestic or international markets as deemed most advantageous.

If anyone would like to dig further into Alliance Resource Partners, we suggest you follow Mohnish Pabrai’s advice and start your research by reading the Value Investors Club write-ups on the company. You can find all four write-ups here, here, here and here. (A free account is required.)

The Comparison

With that cursory introduction to Alliance complete, we will spend the remainder of this piece explaining why we don’t own Alliance but do own Natural Resource Partners.

Before we dive in, we want to be clear, we aren’t saying Alliance is a bad company or even a poor investment. In fact, there’s a lot to like about the company. For starters, it has beaten the britches off the S&P 500 over the past twenty years.

Alliance is also a highly profitable business producing $154 million in free cashflow last quarter. Its coal assets in the Illinois Basin are some of the lowest cost and highest quality in the country. Another trait we like is the CEO’s ownership of 14% of the company stock and one of his family member’s ownership of another 13%. But even with all these positives, not owning Alliance when we can own NRP instead is a no-brainer.

For all but the newest of our subscribers this bullish view on NRP will come as no surprise. After all, NRP is one of the companies we’ve written about the most. Here are links to our previous posts on the company that provide background on our view.

A Coal Royalty Company—Natural Resource Partners (link)

Another Look at Natural Resource Partners (link)

Coal’s Resilient Future (link)

Portfolio Update (NRP & MSB) (link)

This preference for NRP over Alliance comes down to the difference in the companies’ business models. We believe the difference is captured in the following three facts.

NRP’s business model is capital-light

When originally asked if we had an opinion of Alliance, we did search the ticker symbol and gave the company a few minutes of research. Literally, a few minutes. What we looked for, and what we found, was that Alliance was a coal producer with over three thousand employees. What this means is the company has capex, opex and most importantly labor-related expenses. One doesn’t have to search long to find endless news articles about recent labor union strikes and massive increases in employee salaries. The examples of United Postal Service, Delta Airlines, and the big three auto manufacturers come quickly to mind. While Alliance isn’t suffering from a labor strike, its margins are being hit by increasing cost across the board. Take two quotes from the latest conference call as examples. Speaking about costs, the CFO said:

Segment adjusted EBITDA expense per ton sold for our coal operations was $37.85, an increase of 7.8% versus the 2022 quarter, primarily due to higher labor-related expenses, and higher maintenance costs.

Later he said:

Within Appalachia, we do anticipate higher costs in the back half of the year due to the extended longwall move at Mettiki in the third quarter as well as a normal longwall move scheduled for our Tunnel Ridge mine in the fourth quarter.

The effect of such costs is lower margins and ultimately fewer dollars leftover for investors. Consider that over the last quarter, Alliance reported revenue of $642 million but only $153 million of free cashflow. Only 24% of its revenue was converted to free cashflow.

Compare this to NRP with its royalty-based business model and fifty-four employees. A search for the word “cost” in the company’s Q2 transcript uncovered the following remarks:

Costs for the second quarter of 2023 were $9 million compared to $17 million in the prior year period. This $8 million cost decrease was primarily due to lower interest expense in 2023 from our continued deleveraging and having less debt outstanding.

Later, in regard to third party investments in carbon sequestration projects on NRP’s land, the CEO said:

We really have to see the industry evolve…I think there will be other projects on the other 3.3 million acres we own of CO2 sequestration acreage in the Gulf Coast. I call these some of our call options on greatness. They cost us nothing to maintain.

The lower costs of NRP’s royalty-based business model resulted in $64 million of free cashflow from $91 million in revenue. A free cashflow margin of 70%. We couldn’t ask for a better advertisement for capital-light business models.

NRP has a simple business model

This factor is closely related to the last and is the matter of simplicity. My cohost and I are well aware that for below average dudes like us, it’s imperative to stick with simple businesses if we are to understand them to the depth required. A simple business also generally increases the company’s resiliency.

In its defense, if measuring the complexity of all, let’s say, U.S. business, Alliance would certainly fall on the less-complex side of the scale. That said, it still has those three thousand or so employees with the risk of strikes, compensation cost increases, and injury-related lawsuits. Another concern is as Alliance diversifies it business with acquisitions in the oil & gas space, and particularly, in its New Ventures, there’s the risk that it misallocates capital on some misjudgment. The last note on this point is Alliance’s plans for allocating cashflow is less straight forward than NRP’s. It is simultaneously paying down some debt, making New Venture and oil & gas acquisitions, paying a dividend and with stock buybacks also a possibility.

In contrast, NRP’s fifty or so employees will incur little additional costs even if inflation remains high. The potential for revenue growth, such as investments in greater coal production and carbon sequestration projects, is being paid by its customers. Additionally, since 2014, the company has followed a very simple capital allocation plan: 1) pay off all debt, preferred stock and warrants, 2) invest in opportunities with attractive risk-adjusted returns, and 3) increase common unit distributions. For nine years it has doggedly stuck to this plan. The completion of step one is now measured in months not years as the chart below shows. This is a plan even we can understand.

NRP is well positioned for coal’s future

The last major factor that turns us off of Alliance and toward NRP instead is how each company is positioned in the coal sector. On the one hand, Alliance produces mainly thermal coal and sells a majority of its tonnage to domestic U.S. utility customers. In 2022, for example, 82% of its tonnes sold were purchased by domestic electric utilities and only 13% were sold into the international markets. On the other hand, NRP’s revenue from metallurgical coal dwarfs its revenue from thermal coal. As an example, take a look at what we wrote in a previous piece concerning Alpha Metallurgical Resources, which is NRP’s largest customer:

While Alpha Metallurgical Resources is a Tennessee-based company with its operations in Virginia and West Virginia, currently 70% of its product is shipped to 26 foreign countries and in the last quarter, 90% of its revenue came from met coal.

At the risk of being called pessimists, we think a business built around selling metallurgical coal to international customers will fair better than a one selling thermal coal domestically in the United States.

The Conclusion

As we wrap up this piece, we’ve concluded that although Alliance Resource Partners didn’t make the cut as worth investing in (at least for now), we learned a lot about the coal industry through the time spent researching it. The biggest take away though, is how it further cemented our interest in capital-light businesses. We certainly don’t believe capital-light is the end-all-be-all trait of a good investment, nor do we only own capital-light businesses. But we do believe the nature of this model increases the odds of a company first surviving, and second, out performing.

But don’t take it from us. Here’s how Charlie Munger replied to an eight year old girl when she asked why he and Buffett don’t only invest in capital-light businesses. He said:

Yes, I like the aspiration of that young lady. She basically wants her royalty on the other fellow’s sales. And of course that’s a very good model, and if everybody could do that, why, nobody would do anything else.

With that, thanks for reading and listening. We hope you are learning from and thoroughly enjoying these weekly pieces. My cohost and I can’t thank each of you enough for the support and encouragement we’ve gained from all your comments and likes. A few of you are now regularly reaching out to us via email and those conversations have been particularly beneficial. Honestly the best way to encourage us and keep us going is to become a free subscriber and if you’re a Substack creator yourself, recommending our work on your page is massively appreciated. For those who already have, thank you! We’ll see you all next Saturday with more actionable investing insights.

Content worth sharing

Share this post