You can enjoy the Special Situation Investing Podcast on Fountain or wherever you listen.

Welcome to Episode 64 of Special Situation Investing.

After reading the title of this episode — Natural Resource Partners — and if you know that NRP is not a tobacco company, it may seem odd to kick off with a Warren Buffett quote about tobacco stocks. But here goes. He said:

We have owned — we won’t comment on what we own now — but we have owned tobacco stocks in the past. We’ve never owned a lot of them, although we may have made a mistake by not owning a lot of them.

Let us explain.

For years, we’ve been fascinated by the apparent contradiction of US tobacco stocks handily outperforming the market even while US tobacco consumption has declined for decades. For context, consider that its been illegal for cigarette companies to advertise since 1970 and the rate of US adults who smoke has fallen drastically from 42% in 1965 to only 13% in 2018. Tobacco as a sector is clearly in decline.

But surprisingly, even while in a declining sector, tobacco companies have been a fantastic investment in terms of total return. As an example, Altria Group, a holding company of mainly tobacco products, has massively outperformed the market since its inception as a public company in 1985. The chart below, that only goes back as far as 1995, shows Altria rewarded shareholders with an average annual return of 14% verses 9.4% for the S&P500. Going back further, the company outstrips the market to an even greater degree.

This blatant divergence between a sector in decline and the performance of the stocks within it makes one wonder how it occurred. Certainly there are many contributing factors but we believe a couple in particular led to this phenomenon: 1) the tobacco sector, companies and products are generally hated in our culture, and often considered non-investable, leading to depressed multiples and high dividends, and 2) the product is both simple with little to no innovation needed to keep it relevant and needed (by some), particularly outside the US.

While intrigued by the sector’s outstanding performance, we have never owned any tobacco stocks, but we have kept our eyes out for situations with a similar setup.

We believe the coal sector has many of the same attributes today.

Coal, if not the most hated industry, is definitely a contender for that less-than-enviable top position. And even after the sector’s face-ripping appreciation over the last two years, coal companies are still sitting with P/E ratios in the low single digits, with shareholder payouts far above the market average. Such facts point to how many investors consider these companies non-investable.

At the same time, while many in the world would love to breakup with coal once and for all, in 2022 the globe set a new record for coal consumption. And these levels are expected to remain elevated for years as growing demand in emerging economies make up for cutbacks in advanced economies. One has only to look at recent increases in coal sourced power production in India and Germany to sense just how badly the world still needs coal to sustain itself. While coal may not be chemically addictive, the increase in standard of living its cheap energy provides certainly is. For a very comprehensive write-up on this topic, check out Arjun Murti’s article, The Right and Wrong Lessons to Learn From Coal's Global Resilience.

So, given the possible bull case for coal, should investors buy coal miners expecting tobacco-stock-like returns? As you might guess from securities we’ve recommended in past episodes, we aren’t interested in the average coal miner. We do see hard assets as a good bet in this age of loose currency but we prefer companies with business models that are asset-light, with few employees and little need for large inventories or large capital expenditures. We believe these types of companies are likely to do well with low inflation and very well with high inflation. With this mindset, we particularly like royalty companies.

This brings us to the topic of today’s episode, Natural Resource Partners (ticker NRP).

The company

A $675 million market cap company, Natural Resource Partners has fifty-four employees and $189 million in debt. It’s helpful to think of the company in terms of its two operating segments, first, its mineral and subsurface rights ownership, and second, it’s 49% stake in Sisecam Wyoming LLC, a private soda ash producer.

The company’s first segment derives revenue from mineral and subsurface rights it owns on 13 million acres in the United States. That acreage, if combined into a single plot, would cover an area twice the size of the state of Maryland or half the size of Ohio. NRP leverages these acres primarily by leasing rights to coal mining companies. These mineral assets are primarily located in the Appalachian Basin, Illinois Basin and Powder River Basin. NRP itself does not participate in any mining. Ninety percent of NRP’s revenue comes from its mineral rights segment, the vast majority of which comes from coal royalties.

In addition to coal mineral rights, NRP leases out rights on oil and gas, receives lease payments for coal transportation equipment, sells timber for lumber and it also has construction aggregate assets across the US that include minerals such as limestone, frac sand, lithium, copper, lead and zinc.

Increasingly over the last few years, NRP produced revenue off its land by tapping into environmentally green initiatives and renewable energy projects. These revenue streams include selling carbon credits off its vast timber lands in West Virginia, leasing land for wind and solar projects, as well as a recent venture into geothermal energy.

A final and growing part of NRP’s green initiatives is leasing its subsurface rights for carbon sequestration projects. NRP owns the subsurface rights to approximately 3.3 million acres mainly in the southern United States. Over the last year, NRP has leased two sequestration projects for a combined 140,000 acres which will allow for approximately 800 million cubic feet of carbon storage capacity.

The second operating segment of NRP is its 49% stake in Sisecam Wyoming LLC a trona ore mining operation and soda ash refinery in the Green River Basin of Wyoming. As a minority owner, NRP has no responsibility for operating expenses. Sisecam is one of the largest and lowest cost producers of soda ash in the world. Soda ash is an essential raw material in flat glass, container glass, paper, chemicals, detergents, and sundry other necessary consumer and industrial products. And as a kicker, the process of mining trona to produce soda ash is much cleaner and environmentally friendly than the synthetic process used to produce 70% of the world’s supply.

For those of you who want to dive deeper into the company, here’s a link to NRP’s website as well as two detailed and recent VIC write-ups (here and here).

Why we’re interested

We find Natural Resource Partners an interesting situation for three reasons.

Our first reason for in interest in NRP was touched on earlier, so here’s just a quick summary. We believe that coal stocks, because of how hated the coal industry is, and at the same time how necessary it is, could give investors market-beating returns for decades to come. And within that industry we are interested in NRP particularly because of its hard-asset, asset-light business model that we believe will do well in a variety of future outcomes. Alright, enough said about that. Let’s get into the more interesting reasons.

The second reason we like NRP is because we believe it’s incredibly cheap.

First a little further background. Remember that NRP is a minority owner in Sisecam Wyoming LLC, the soda ash producer. The other 51% is the sole asset owned by another public entity called Sisecam Resources LP (ticker SIRE). Last week, on the first of February, Sisecam Resources LP, or SIRE, agreed to merge into a company called Sisecam Chemicals Wyoming LLC, which itself is a wholly owned subsidiary of Sisecam Chemicals Resources LLC. We agree, it all sounds very confusing and it is. But what’s important to us is the price paid for the 51% of Sisecam Wyoming.

That price was $25 per share. Since there are 20 million shares outstanding, upon the news of the merger, SIRE’s market cap hopped up 3% and now hovers at just about $500 million. So if a 51% stake is worth $500 million, NRP’s 49% stake would theoretically be worth $480 million.

At the time of this writing, NRP has a market cap of $675 million. So taking out the $480 million for the soda ash stake leaves one with a valuation of $195 million for the rest of the partnership. So if that’s the price the market is by default assigning to the mineral rights segment, the next logical question is, what earnings would we get for such a price?

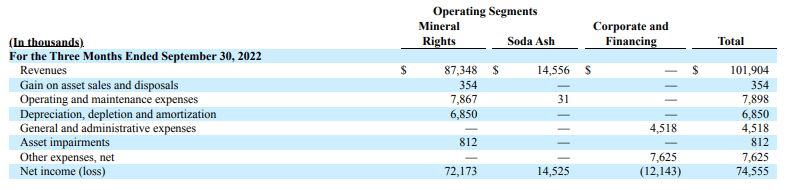

In its SEC quarterly and annual filings, NRP delineates between its two operating segments — mineral rights and soda ash — tabulating the net incomes for both segments. This makes calculating a hypothetical PE ratio for the mineral rights segment quite easy. As the table below shows, in Q3, ending 30 September 2022, NRP’s mineral rights segment produced $72.2 million of net income. (Side note: that’s compared to only $14.5 million for the soda ash segment.) Annualizing these numbers and subtracting corporate/financing costs gives a net income of $240 million and a hypothetical PE ratio for the mineral rights segment on its own of 0.81. Using the more conservative estimate of the net income over the nine months ended 30 September 2022 produces a hypothetical PE ratio of 0.91.

Think of the situation from the perspective of what Buffett calls a private owner. Let’s pretend my co-host and I made the trade of our lives shorting Cathy Wood’s ARK Innovation ETF and we reallocate the proceeds by buying all of Natural Resource Partners. Let’s assume we buyout the company at its current price of $675 million. We could then sell the soda ash stake for $480 million leaving us essentially paying $195 million for the remaining company, the mineral rights segment. Our remaining company could then potentially reward us with $240 million dollars per year. Hey, if we had the money we might just do that!

The third reason we are intrigued by NRP, and why we encourage you to conduct further research on it, is because it has multiple avenues for growth and appreciation.

The company’s stated priorities are:

Pay down debt

Redeem preferred equity

Invest in opportunities with attractive risk-adjusted returns, and

Increase common unit distributions

Top of the company’s list is repaying its debt. Since 2015, NRP has aggressively pursued its top priority, reducing its debt by more than $1.2 billion. Currently the company is down to $189 million.

Additionally, the company has $250 million in preferred stock on which it pays a 12% yield. This led NRP to paying $30 million over the last year. Due to the terms of the preferred, there is currently a 20% premium that NRP would be required to pay to redeem the preferreds if it was so inclined. That premium decreases with every distribution. While the company management said it is open to paying off the preferreds early, a conservative estimate of timing is when the premium is eliminated, which will be in approximately seven quarters.

So with current levels of cashflow, we conservatively expect the company to be debt free in under two years.

After paying off all of its debt and its preferred equity, NRP’s next goal is to invest in value-additive opportunities. Reviewing the company’s quarterly calls makes it clear they are very optimistic about the potential in leasing their subsurface rights for carbon sequestration. It takes very specific geological composition to create an underground carbon sequestration project and NRP believes it has the largest accumulation of such areas of any company in the United States. As stated earlier, of its 3.3 million subsurface right acres, NRP has only leased out 140,000, or 4.2%.

Additionally, NRP is seeing its coal leasees increase their capacity, increases in oil and gas royalties from their properties in the Haynesville area, and new interest in geothermal, solar, and wind power generation projects. Through it all, NRP reiterates its commitment to remaining a royalty company, meaning each of these new projects will be leased out and NRP will simply collect the checks. More leases correlates to more revenue which, because of NRP’s asset-light business model, drops almost entirely to the bottom line.

Which leads to NRP’s final and ultimate goal — increasing shareholder distributions. With zero debt in the near future, increasing leases and royalties, and particularly if coal demand and prices remain elevated, it’s very likely that NRP will continue its recent trend of increasing returns to shareholders. And management is particularly incentivized to do so because they own 25% of the stock.

And with that we conclude another episode of Special Situation Investing. Thank you for all the support and feedback you’ve been sending our way. Thanks for using the Fountain app to listen to the show and for sending us bitcoin boosts through that platform. Perhaps the most impactful way you can show your support is by going over to our Substack and becoming a free subscriber.

Your support is much appreciated and encouraging as our goal is that each of these episodes be as enjoyable and educational for you as they are for us.

Alright, we’ll be back again next week with another episode.

Share this post