Welcome to Episode 137 of Special Situation Investing.

Recently, my cohost and I have focused our research on what AI data centers could mean for the Permian Basin. Although data centers are a hot topic in financial news, their connection to the Permian is not yet mainstream. Hat tip to Murray Stahl and Horizon Kinetics for being among the first for to make the connection. But the topic appears to be garnering attention and is now popping up more frequently.

One such occurrence was during Doomberg’s appearance on Macro Dirt. While discussing his current thoughts on uranium and the progress of companies trying to add more nuclear power to the grid, the green chicken made the following remarks:

One of the biggest things that I see going on right now that few are talking about is this is all going to have to go off grid. So you saw this rejection by FERC of Amazon's collocation deal. That collocation deal was signed with an existing nuclear power plant that feeds the grid. The grid powers multiple states which means the feds regulate it and the grid can't take much more incremental demand they're slow anyway. Getting connected with new facilities to the grid is a challenge and takes forever. So you're going to see off-grid, isolated pods where natural gas or uranium go in the front and then data comes out the other. It's far easier to send data around the world than it is to send natural gas or radioactive uranium fuel rods and so they're going to do it offline and if you do it offline in the Permian you just need the Texas Railroad Commission to approve and FERC has no say. So this is the trend and any companies that enable that, you want to get long…I think the real trend is pop your tent in the Permian and don’t even bother with the grid.

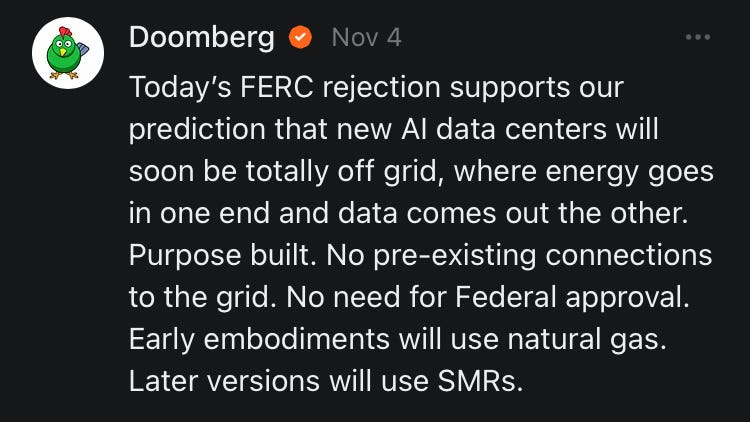

Here’s how Doomberg summarized the situation in a Note of Substack:

While we tend to think it will be a while before natural gas is replaced by nuclear SMRs as the go-to power source, we agree wholeheartedly with Doomberg’s arguments.

Texas is already experiencing an massive increase in requests to join its grid. In fact, from the beginning to the end of this past summer, the Houston electric utility experienced a 700% increase in requests from data centers wanting to connect. Observing this tsunami of demand, Thomas Gleason, chairman of the Public Utility of Texas, admitted that these data centers will need to supply at least some of their own power.

All of this supports the thesis that data centers will come to Texas to access its ample rural land, cheap natural gas, and plentiful produced water, which is bullish for companies that can supply some or all of these resources.

One company alert to this opportunity is Chevron, one of the largest operators in the Permian Basin. At at a conference back in September, Chevon’s CEO, Mike Wirth, said, “Natural gas will help power the rapid growth of artificial intelligence with its insatiable demand for reliable electricity. [This] means AI's advance will depend not only on the design labs of Silicon Valley, but also on the gas fields of the Permian Basin.”

Mentions in Company Calls

Another place we have begun to see this topic crop up is in earnings calls. Logically, one such company was Texas Pacific Land. Its CEO was asked during the Q&A how TPL is managing its vast West Texas surface acreage. He responded:

I mean surface is a fantastic asset. I think the thing we like about it the most is just the optionality that you have. Minerals are a great asset as well, but you don't have as much control over the actual development. Whereas surface, you can be more proactive and kind of have more control over how and when that asset is developed. So as far as non-oil and gas revenue, it's pretty immaterial today, but we've signed a lot of contracts in the last couple of years.

I think we've got over 700 megawatts of solar that we've contracted in the last 24 months that's in development phases. We've got seven utility-scale battery projects going. I think we've got four Bitcoin mines, like 78 megawatts that are active today with another 50 in development stages. So I think there's a lot of opportunity outside of oil and gas.

We've seen an increase in wind power interest lately. And then there's been a lot of talk about data centers, as you know, I think Diamondback and Permian Resources have mentioned that lately. But that's something that we've been working on for some time now. And if you think about data centers in the form compute centers, then we’ve actually got a couple of small compute centers in the form of Bitcoin mining…that are up and running with a couple more in negotiations.

So we know what it takes to negotiate these things and every deal is unique, but if you think about the large data center you might see for hyper scalers, those are still in the early days of development for the Permian. And I would just say that there's a lot of conversations taking place within the industry and definitely within TPL.

Given the heads up that Diamondback and Permian Resources talked about data centers, I read those earning call transcripts next. Here’s what the CEO of Diamondback Energy (FANG) had to say:

We have about 65,000 acres in our portfolio. We also control a lot of molecules. So I think the mandate…from our investors, is to stop selling gas for zero…

And so we're going to find ways to benefit Diamondback shareholders by finding a new local market for our gas, but also insulating part of our business from what we believe to be an increasing power price in Texas over the next 10 years. So if we can cut off that cycle and benefit Diamondback shareholders, we're going to do it.

I think the message we kind of put out there is that West Texas, has a lot of land, a lot of surface. It has a lot of gas that's, being sold for less than it should. It's got a lot of water production with that oil production that we have in the basin. And I think that results in a very cheap way to develop power. And the data center operators have not been focused on the Permian yet. There's certainly some conversations that are happening, and we're kind of putting the flag out there that this is a very cheap way to execute their business model while benefiting Diamondback shareholders.

Permian Resources’s (PR) CEO shared a similar message: the benefits of AI data centers could be twofold, a boon for companies with surface acreage to lease as well as a tailwind to all Permian producers if it increases the local natural gas price. Responding to how his company is managing its surface acres, he stated:

I think specific to the surface…I think really there's potentially some interesting developments that I think ultimately take time, but could provide ways for us to work with more infrastructure related parties to really fully optimize the value from that surface. I mean…as we look at AI data center demand, we think that's going to be real in the United States going forward.

And I think especially with administration changes, I think natural gas is really well positioned to be a beneficiary of changes in the power consumption landscape going forward. And we think that the Permian Basin and Permian Resources particularly should be very well positioned to benefit from that tailwind and should help in basin natural gas prices over time.

I mean, if you think about the Permian, we've got abundant natural gas, we've got a supportive regulatory environment. We've got a very rural landscape and a tremendous long dated inventory with a lot of gas that historically has been pretty cheap. So I think we're really optimistic that that can provide a tailwind on the gas side of the business in the coming years.

And last but not least, of course, there is Landbridge (LB)—a new company and one of our highest conviction, long term plays. Its CEO, Jason Long had the following news on data centers:

As mentioned last quarter, West Texas is an increasingly popular area for renewable energy and digital infrastructure development and our acreage is ideally situated for data centers to support AI and cloud computing services, which require low-cost fuel, water for cooling and fiber optic infrastructure. As a reminder in July, we signed a nonbinding letter of intent for a long-term ground lease for the development of a data center.

This month in November, we executed a lease development agreement for the development of a data center and related facilities across approximately 2,000 acres of our land in Reeves County Texas. The lease development agreement includes among other things, a nonrefundable $8 million deposit due in December 2024 for a two-year site selection period and construction of the data center within a subsequent four-year period.

Upon initiation of construction of the data center the counterparty will make escalating annual lease payments along with additional payments based on the net revenue received with respect to the power generation facilities to be located on the lease property.

Landbridge’s lease development agreement is the only case we know of where a data center is actually in the process of being put in the Permian. Even so, it is going to be approximately a six-year process before it’s fully operational. But it’s the first proof that this trend could result in real cash flow for Permian Basin landowners. Since we are long term investors, we continue to dollar cost average into Landbridge and other companies to express our growing conviction in the Permian Basin data center trend. We are happy Doomberg’s advice matches our thesis as we continue to camp out in the Permian.

That wraps up this latest episode of the show. Thanks for listening and reading. Feel free to reach out with your thoughts on opportunities to see over the horizon as well as where you believe we could use a course correction. We’ll see you all again in two week’s time.

Share this post